Sentiment: Bullish

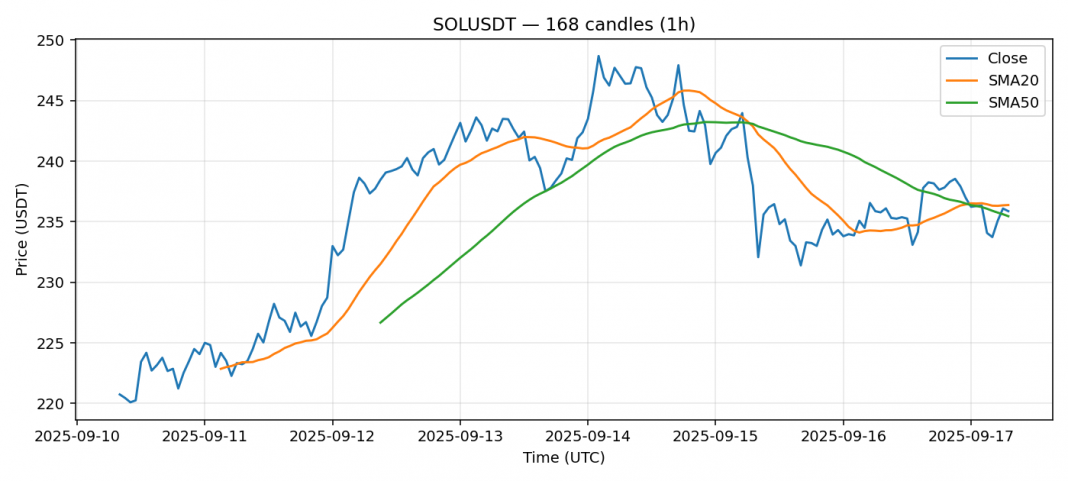

SOL is currently trading at $235.86, showing a slight 24-hour decline of -0.106%. The RSI reading of 37.29 indicates the asset is approaching oversold territory, which often presents potential buying opportunities for swing traders. Price is hovering near both the 20-day SMA ($236.38) and 50-day SMA ($235.45), suggesting a critical technical juncture. The relatively high volatility of 2.83% combined with substantial 24-hour volume of $775M signals active market participation. Given the oversold RSI and proximity to key moving averages, I recommend considering long positions with tight stop-losses below $230. A break above $240 could trigger momentum toward $250 resistance. Monitor Bitcoin’s movement closely as SOL typically correlates with broader market trends.

Key Metrics

| Price | 235.8600 USDT |

| 24h Change | -0.11% |

| 24h Volume | 775783945.96 |

| RSI(14) | 37.29 |

| SMA20 / SMA50 | 236.38 / 235.45 |

| Daily Volatility | 2.83% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).