Sentiment: Neutral

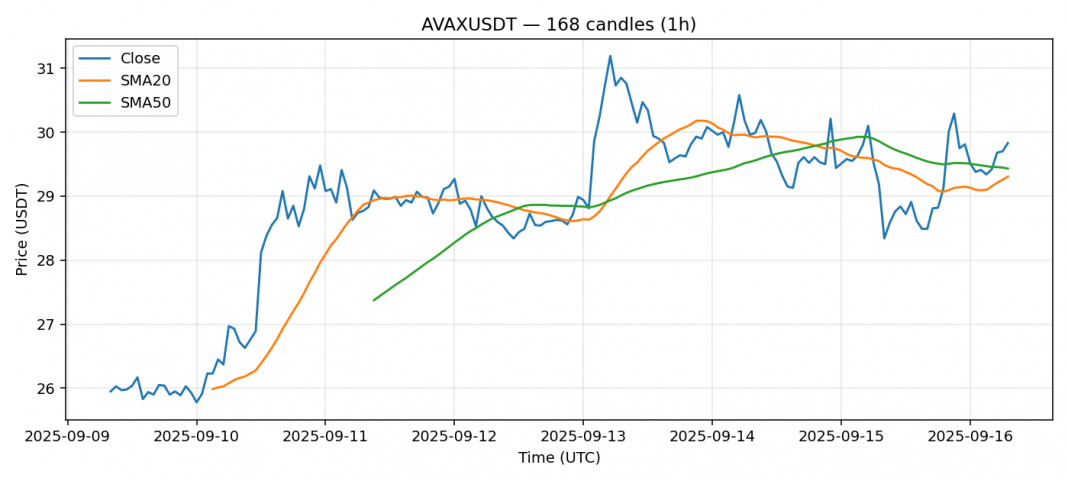

AVAX is showing resilience, trading at $29.83 with a modest 0.81% gain over the last 24 hours. The current price sits just above the 20-day SMA ($29.31) but slightly below the 50-day SMA ($29.43), indicating a potential consolidation phase. The RSI at 66.45 is approaching overbought territory but hasn’t crossed the critical 70 threshold yet, suggesting there might be some room for upward movement before a pullback. Volume is healthy at nearly $137 million, providing decent liquidity. Given the moderate volatility of 4.76%, I’d advise caution on large positions here. Consider scaling into longs on any dip toward the $28.50 support level, with a tight stop below $28. If we break and hold above $30.50, it could signal a run toward $32. Manage risk carefully in this choppy environment.

Key Metrics

| Price | 29.8300 USDT |

| 24h Change | 0.81% |

| 24h Volume | 136895576.52 |

| RSI(14) | 66.45 |

| SMA20 / SMA50 | 29.31 / 29.43 |

| Daily Volatility | 4.76% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).