Sentiment: Neutral

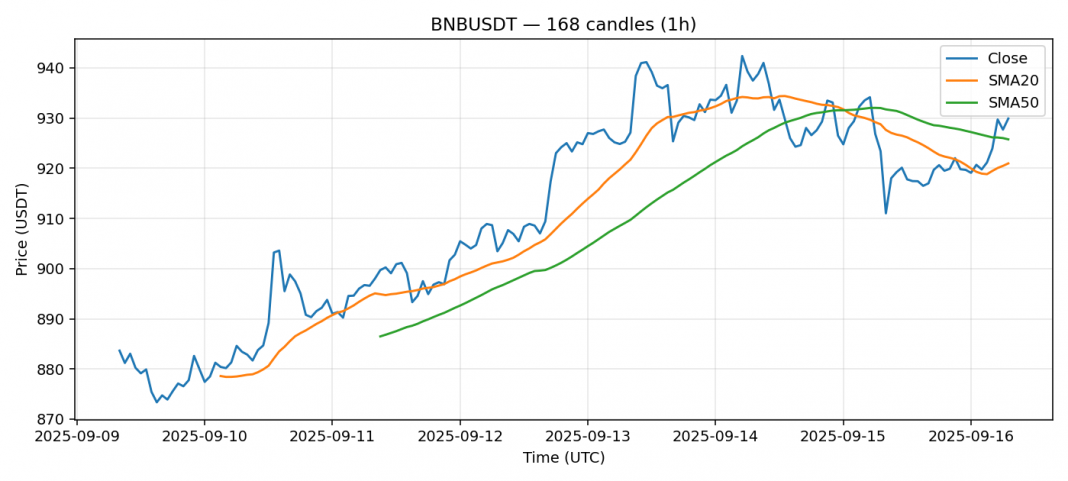

BNB is showing resilience, trading at $929.91 with a modest 0.17% gain over 24 hours. The price is hovering just above the 20-day SMA at $920.97 but remains below the 50-day SMA at $925.77, indicating near-term consolidation with slight bullish undertones. The RSI reading of 71.07 suggests the asset is approaching overbought territory, which could signal a potential pullback if buying pressure wanes. Volume is healthy at over $166 million, supporting current price levels. Given the elevated volatility of 1.73%, traders should prepare for sharp moves. My advice is to consider taking partial profits if long, as the RSI warns of overheating, and wait for a dip toward the $920 support for better entry opportunities. A break above $935 could target $950, but risk management is key here.

Key Metrics

| Price | 929.9100 USDT |

| 24h Change | 0.17% |

| 24h Volume | 166333317.01 |

| RSI(14) | 71.07 |

| SMA20 / SMA50 | 920.97 / 925.77 |

| Daily Volatility | 1.73% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).