Sentiment: Neutral

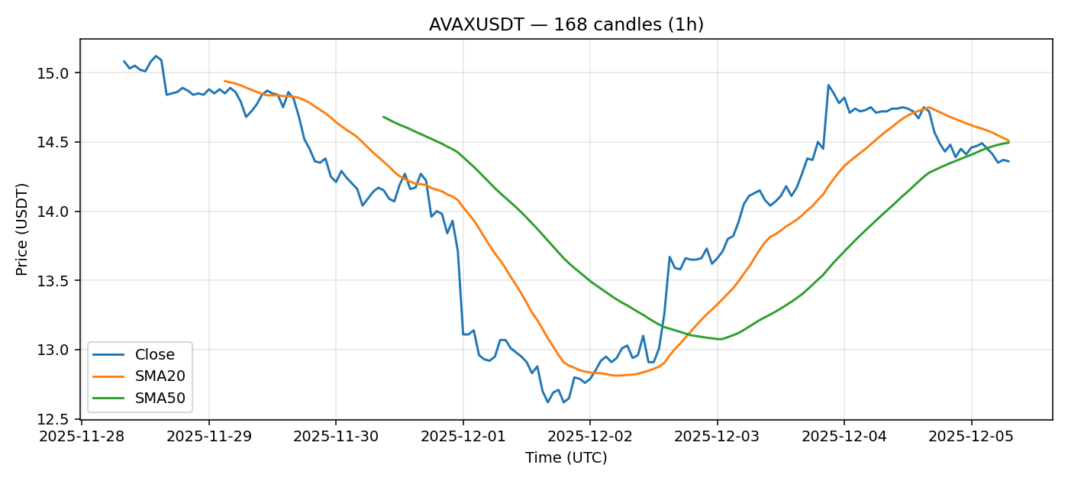

AVAX is showing signs of capitulation as it trades at $14.36, down 2.3% over the last 24 hours. The key technical indicator flashing is the RSI, which has plunged to approximately 33.3, firmly in oversold territory. This suggests the recent sell-off may be overextended. The price is currently trading just below both its 20-day SMA ($14.51) and 50-day SMA ($14.49), indicating a breakdown of short and medium-term support. However, the convergence of these moving averages suggests a potential inflection point. Trading volume remains elevated at $34.8 million, confirming the high activity but not necessarily signaling a definitive bottom. For traders, this oversold RSI presents a potential contrarian long opportunity for a technical bounce, but any position should be guarded with a tight stop-loss below recent lows, as volatility remains elevated at 3.6%. The market is testing key levels, and a failure to reclaim the $14.50 SMA zone could see further downside.

Key Metrics

| Price | 14.3600 USDT |

| 24h Change | -2.31% |

| 24h Volume | 34849455.63 |

| RSI(14) | 33.33 |

| SMA20 / SMA50 | 14.51 / 14.49 |

| Daily Volatility | 3.59% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).