Sentiment: Neutral

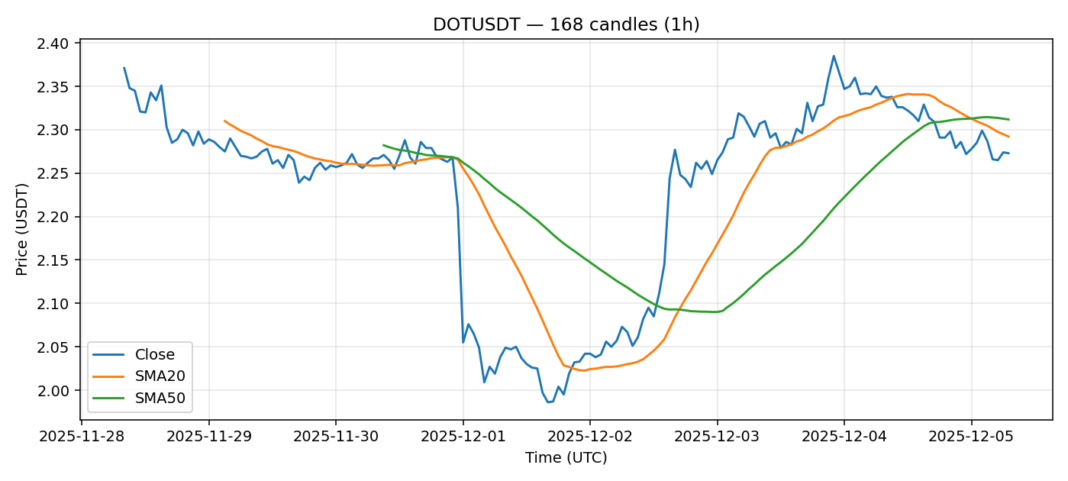

Polkadot (DOT) is showing signs of consolidation after recent selling pressure, trading at $2.273 with a 2.86% decline over the past 24 hours. The asset is currently testing key technical levels, with its price sitting just below both the 20-day SMA ($2.292) and 50-day SMA ($2.312), indicating potential resistance overhead. The RSI reading of 36.76 places DOT in oversold territory, suggesting the selling momentum may be exhausting itself and a near-term technical bounce could be in play. Trading volume remains healthy at over $13.3 million, providing sufficient liquidity for both entry and exit. For traders, the current levels present a potential accumulation zone for those with a longer-term bullish thesis on Polkadot’s ecosystem. However, a decisive break and close above the $2.31-$2.32 SMA confluence is needed to signal a shift in short-term momentum. Risk management is crucial; consider setting stops below recent swing lows.

Key Metrics

| Price | 2.2730 USDT |

| 24h Change | -2.86% |

| 24h Volume | 13371611.14 |

| RSI(14) | 36.76 |

| SMA20 / SMA50 | 2.29 / 2.31 |

| Daily Volatility | 4.61% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).