Sentiment: Neutral

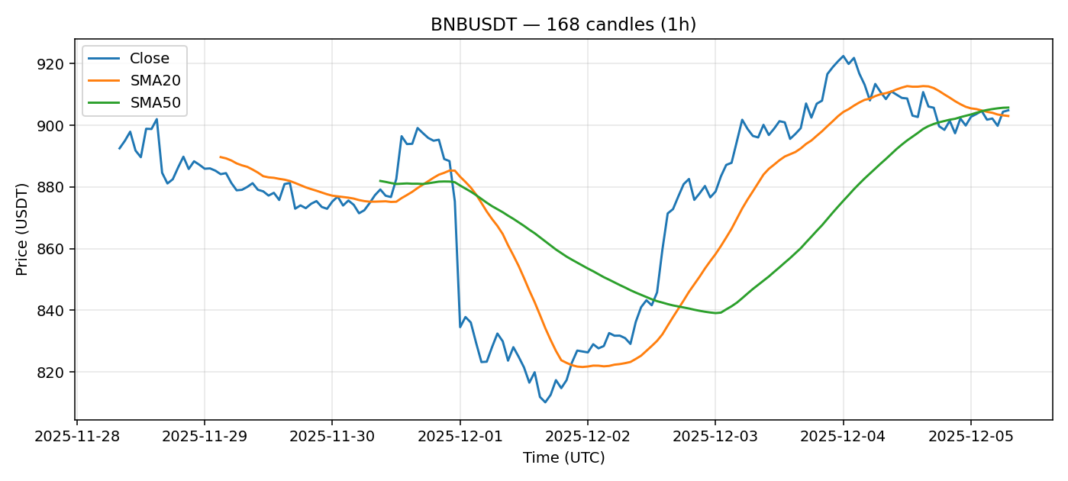

BNB is consolidating around the $905 level, showing a slight 24-hour decline of 0.93% amid moderate trading volume of $111 million. The price is currently sandwiched between the 20-day SMA at $903 and the 50-day SMA at $905.75, indicating a critical inflection point. The RSI reading of 48.87 suggests neutral momentum, neither overbought nor oversold, while the 2.98% volatility metric points to relatively contained price swings. For traders, this setup suggests a wait-and-see approach. A sustained break and close above the $906-$908 resistance zone, particularly with increased volume, could signal a move toward $920. Conversely, failure to hold the $900 psychological support could see a test of the $890 level. Position sizing should remain conservative until a clearer directional bias emerges from this tight range.

Key Metrics

| Price | 904.8500 USDT |

| 24h Change | -0.93% |

| 24h Volume | 111045373.88 |

| RSI(14) | 48.87 |

| SMA20 / SMA50 | 903.02 / 905.75 |

| Daily Volatility | 2.98% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).