Sentiment: Neutral

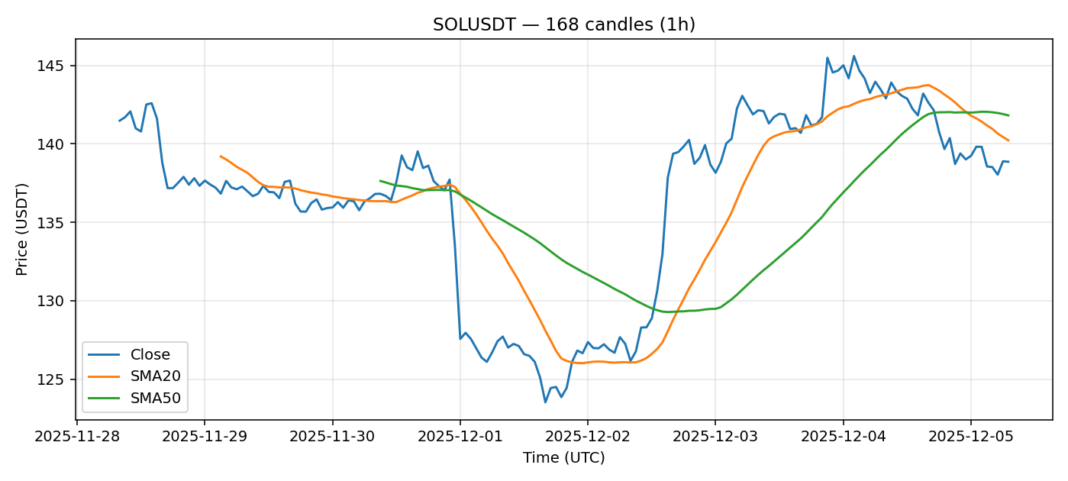

Solana (SOL) is showing signs of capitulation after a sharp 3.5% decline over the past 24 hours, bringing its price to $138.86. The key technical indicator flashing is the RSI, which has plunged to deeply oversold territory at 32.44, suggesting the selling pressure may be nearing exhaustion. Price is currently trading just below both the 20-day SMA ($140.23) and the 50-day SMA ($141.82), indicating a bearish near-term structure, but the proximity to these moving averages could provide immediate resistance or a springboard for a relief rally. The high volatility reading of 3.87% confirms the market’s nervousness. For traders, this presents a classic contrarian setup. Aggressive buyers might look for a bounce from these oversold levels, using a break and hold above the $141.50-$142.00 (SMA50) zone as confirmation for a short-term recovery trade. However, with the trend still technically down, any long positions should be managed with tight stops below the day’s low. The substantial $371M in 24-hour volume indicates strong institutional interest at these levels, which could provide a floor.

Key Metrics

| Price | 138.8600 USDT |

| 24h Change | -3.52% |

| 24h Volume | 371236208.19 |

| RSI(14) | 32.44 |

| SMA20 / SMA50 | 140.23 / 141.82 |

| Daily Volatility | 3.87% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).