Sentiment: Bullish

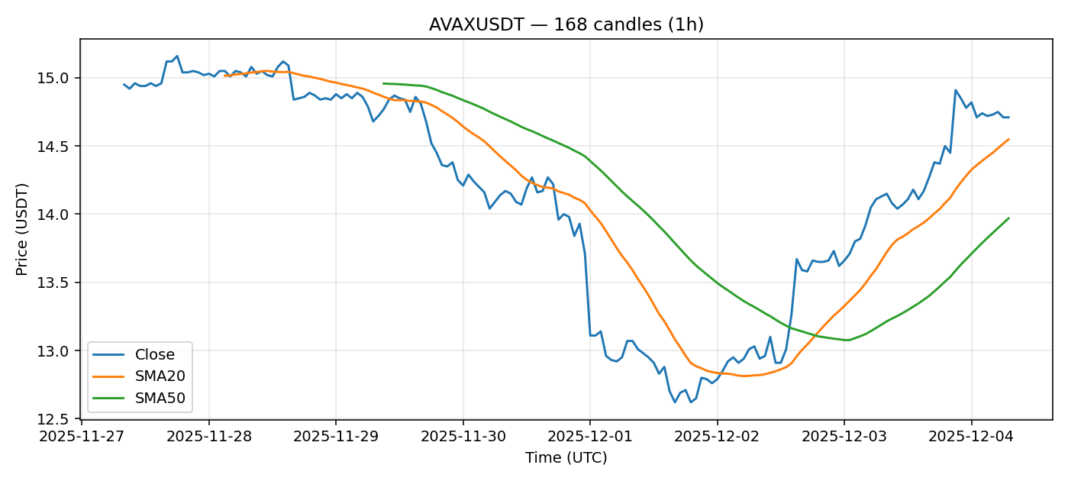

AVAX is showing constructive price action, trading at $14.71 with a solid 4.33% gain over the last 24 hours. The asset is currently positioned above both its 20-day SMA ($14.55) and 50-day SMA ($13.97), indicating a positive near-to-medium-term trend. The 24-hour volume of $68.5 million suggests healthy participation in the move. However, the RSI reading of approximately 66 is approaching overbought territory, signaling that momentum may be stretched in the short term. The 3.58% volatility reading is moderate for a major altcoin. Traders should watch for a potential consolidation or pullback to the $14.00-$14.30 support zone, which could offer a more favorable risk/reward entry for continuation. A decisive break and close above the $15.00 psychological level would likely target the next resistance near $15.50. Consider taking partial profits on strength and managing risk with a stop below the 20-day SMA.

Key Metrics

| Price | 14.7100 USDT |

| 24h Change | 4.33% |

| 24h Volume | 68498305.61 |

| RSI(14) | 65.71 |

| SMA20 / SMA50 | 14.55 / 13.97 |

| Daily Volatility | 3.58% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).