Sentiment: Bullish

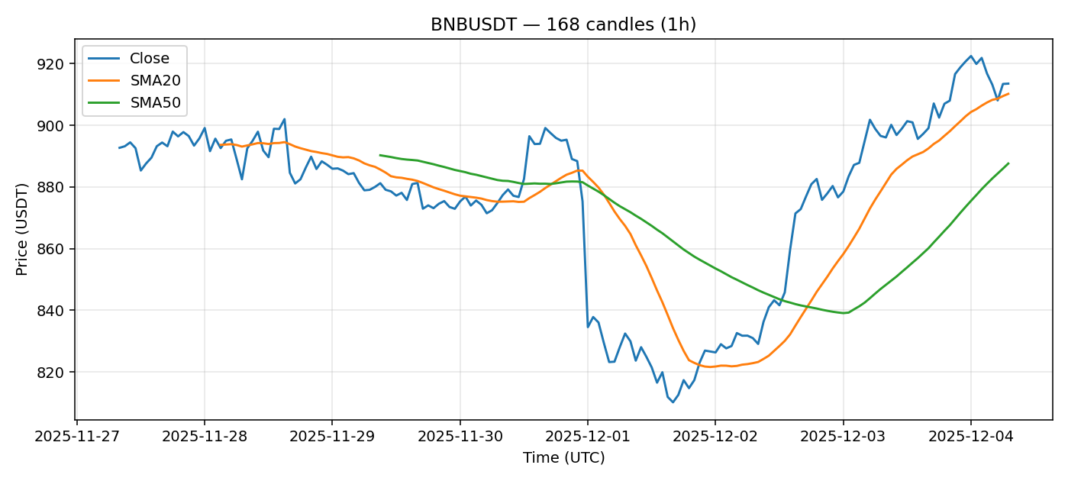

BNB is showing resilience above the $910 level, trading at $913.31 with a modest 1.7% gain over the last 24 hours. The price is currently positioned just above its 20-day Simple Moving Average ($910.20) and has established a solid foothold above the 50-day SMA ($887.59), suggesting a constructive medium-term trend. The RSI reading of 56.67 indicates a neutral-to-bullish momentum, with room for further upside before hitting overbought territory. The 24-hour volume of $193 million is healthy, confirming genuine interest at these levels. However, traders should note the elevated volatility reading of 3.03%, which suggests potential for sharp intraday moves. The key for bulls is to defend the $910-$900 support zone, which now converges with the moving averages. A sustained break above $920 could target the $940-$950 resistance area. For traders, consider long positions on dips toward the $905-$910 support cluster, with a stop-loss below $895. The risk-reward appears favorable for a continuation toward the $930 level, provided the broader market sentiment remains supportive.

Key Metrics

| Price | 913.3100 USDT |

| 24h Change | 1.70% |

| 24h Volume | 193003025.20 |

| RSI(14) | 56.67 |

| SMA20 / SMA50 | 910.20 / 887.59 |

| Daily Volatility | 3.03% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).