Sentiment: Bullish

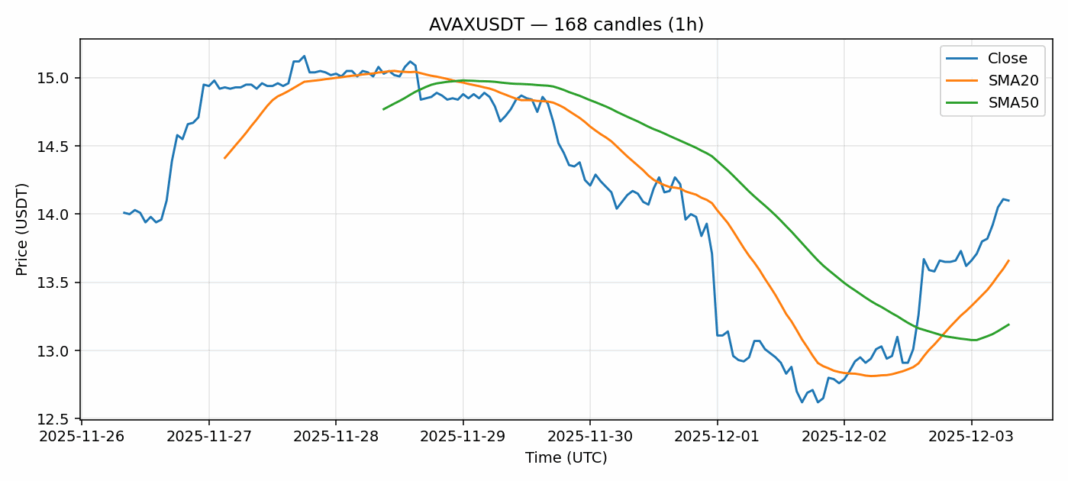

AVAX is showing significant momentum today, surging 8.38% to $14.10 on substantial volume exceeding $71.8 million. The price has decisively broken above both its 20-day SMA ($13.66) and 50-day SMA ($13.19), confirming a strong bullish trend. However, a major caution flag is raised by the RSI reading of 83.33, which indicates the asset is deeply in overbought territory. This extreme reading, coupled with elevated volatility of 3.5%, suggests a high probability of a near-term pullback or consolidation. While the trend is clearly up, traders should exercise caution. Aggressive longs at these levels carry significant risk. A more prudent strategy would be to wait for a healthy retracement towards the $13.60-$13.80 support zone before considering new long entries. Existing holders might consider taking partial profits here and tightening stop-losses to protect gains against a potential reversal.

Key Metrics

| Price | 14.1000 USDT |

| 24h Change | 8.38% |

| 24h Volume | 71829780.51 |

| RSI(14) | 83.33 |

| SMA20 / SMA50 | 13.66 / 13.19 |

| Daily Volatility | 3.52% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).