Sentiment: Bullish

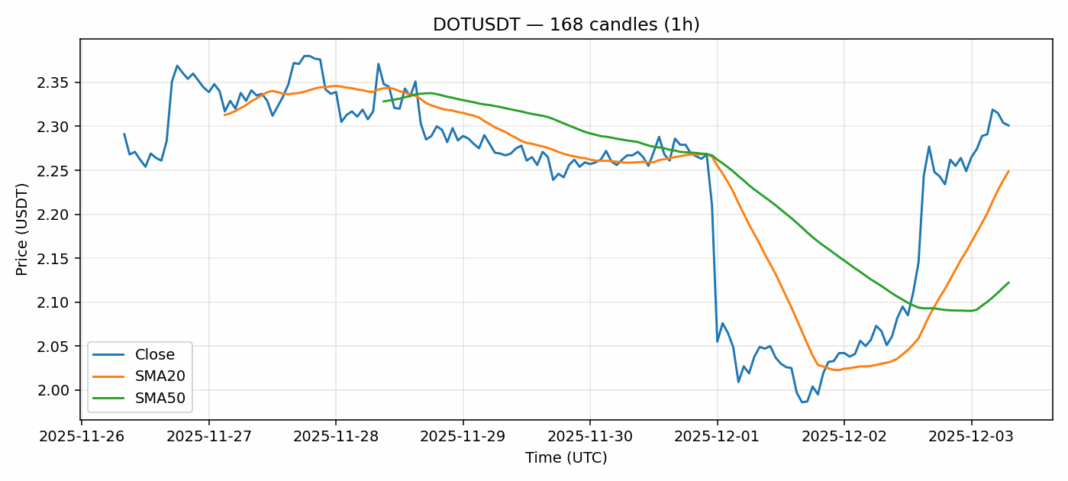

Polkadot (DOT) is showing strong momentum against USDT, surging over 11% in the past 24 hours to trade at $2.30. This breakout is significant as the price has decisively moved above both the 20-day SMA ($2.25) and the 50-day SMA ($2.12), suggesting a firm shift in medium-term sentiment. The RSI reading of 66.46 indicates bullish momentum but is approaching overbought territory, which could signal near-term consolidation. Trading volume is robust at nearly $20 million, lending credibility to the move. The elevated volatility reading of 4.78% suggests traders should expect continued price swings. For active traders, the current setup favors a bullish bias with the SMAs now acting as support. A prudent strategy would be to watch for a pullback toward the $2.25 support zone for potential long entries, with a stop-loss below the $2.12 SMA confluence. Resistance is likely to be tested near the $2.40-$2.50 region, where previous local highs may create selling pressure. Manage risk carefully given the heightened volatility.

Key Metrics

| Price | 2.3010 USDT |

| 24h Change | 11.05% |

| 24h Volume | 19979766.70 |

| RSI(14) | 66.46 |

| SMA20 / SMA50 | 2.25 / 2.12 |

| Daily Volatility | 4.78% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).