Sentiment: Bullish

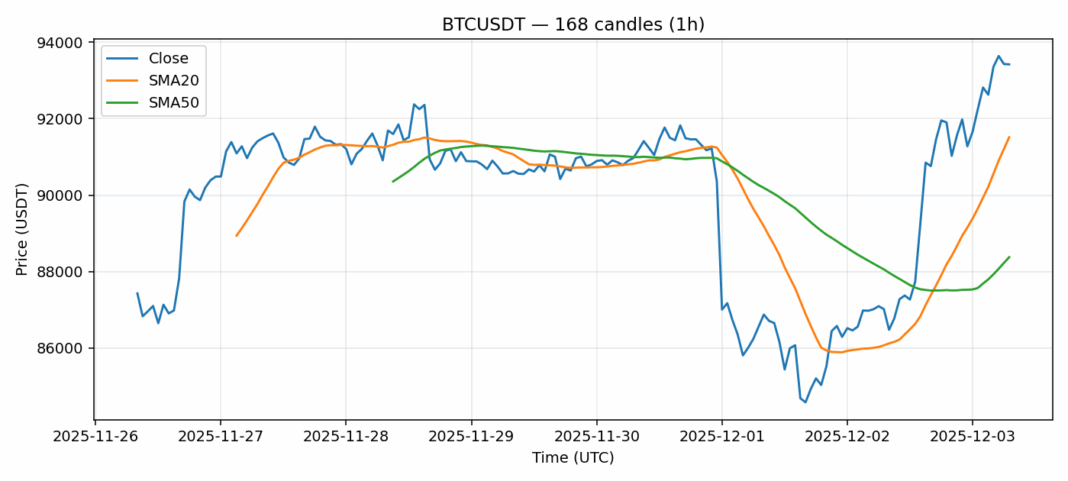

Bitcoin has surged past the $93,000 mark, posting a robust 7.27% gain over the last 24 hours on substantial volume exceeding $2.8 billion. This decisive move places the price firmly above both the 20-day SMA ($91,513) and the 50-day SMA ($88,371), confirming the strength of the current uptrend. The RSI reading of 66.25 is approaching overbought territory but still has room before signaling exhaustion. The elevated volatility suggests traders should brace for sharp intraday swings. For traders, the key support to watch is the $91,500-$91,600 zone (the 20-SMA). A sustained hold above this level could pave the way for a test of the $95,000 psychological barrier. However, given the rapid ascent, a period of consolidation or a pullback to test the new support would be a healthy development. Long positions should consider tight stops below $91,000, while aggressive traders might look for dip-buying opportunities near the 20-SMA.

Key Metrics

| Price | 93429.7500 USDT |

| 24h Change | 7.27% |

| 24h Volume | 2836401313.93 |

| RSI(14) | 66.26 |

| SMA20 / SMA50 | 91513.06 / 88371.48 |

| Daily Volatility | 2.74% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).