Sentiment: Neutral

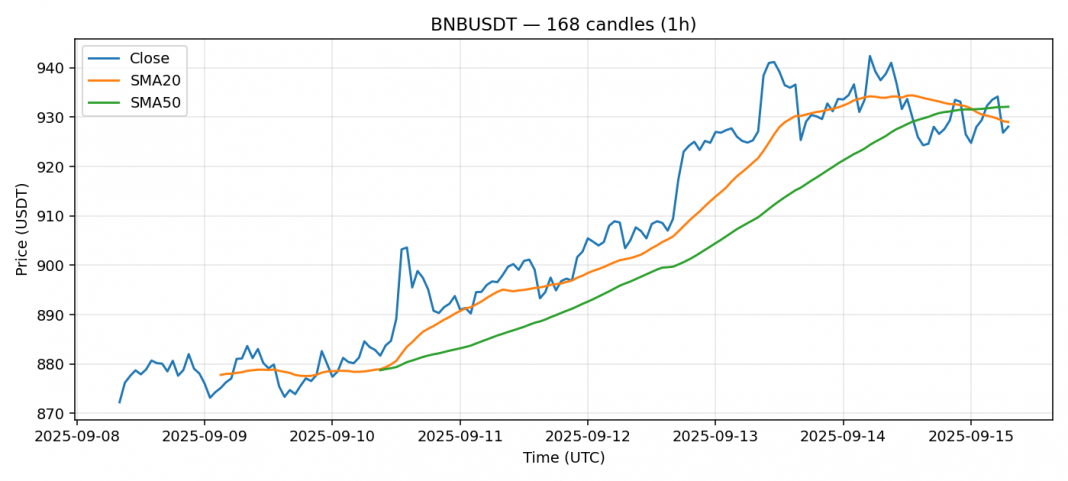

BNB is currently trading at $928.08, showing a slight decline of 1.14% over the past 24 hours. The price is hovering just below the 20-day SMA at $929.01 and the 50-day SMA at $932.10, indicating a neutral to slightly bearish short-term momentum. The RSI reading of 50.06 confirms this equilibrium, suggesting neither overbought nor oversold conditions. Volume remains healthy at $137.88M, supporting current price levels without significant breakout pressure. Given the tight range between key SMAs and low volatility of 1.63%, I expect continued consolidation in the near term. Traders should watch for a decisive break above $935 or below $925 for directional bias. Consider range-bound strategies with tight stop-losses until clearer momentum emerges. Accumulation near $920 could present a favorable risk-reward opportunity for swing positions.

Key Metrics

| Price | 928.0800 USDT |

| 24h Change | -1.14% |

| 24h Volume | 137884354.20 |

| RSI(14) | 50.06 |

| SMA20 / SMA50 | 929.01 / 932.10 |

| Daily Volatility | 1.63% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).