Sentiment: Bearish

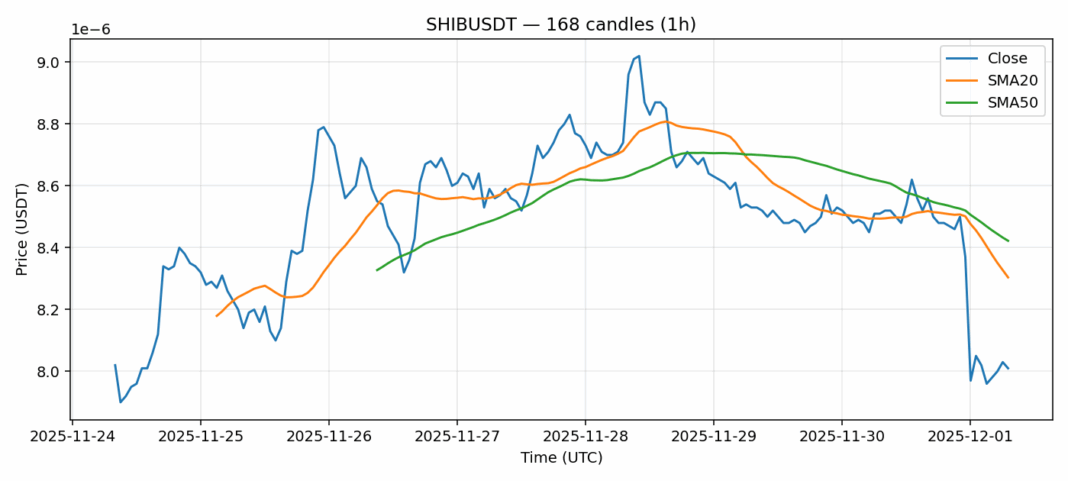

SHIB/USDT is showing significant technical stress, trading at $0.00000801, down 5.77% over the last 24 hours. The asset is currently trading below both its 20-day SMA ($0.00000830) and 50-day SMA ($0.00000842), confirming a bearish near-to-medium-term trend structure. The RSI reading of 21.8 is deeply oversold, suggesting the selling pressure may be nearing exhaustion and a technical bounce could be imminent. However, the elevated volatility of 3.74% indicates continued market uncertainty. Volume remains substantial at $8.95 million, showing active participation. For traders, this presents a high-risk, high-reward scenario. Aggressive traders might consider scaling into a long position here, using the oversold RSI as a contrarian signal, but must employ strict stop-losses below recent lows. Conservative traders should wait for a confirmed reversal pattern and a close back above the 20-day SMA before considering any long exposure. The path of least resistance remains down until key moving averages are reclaimed.

Key Metrics

| Price | 0.0000 USDT |

| 24h Change | -5.76% |

| 24h Volume | 8948028.80 |

| RSI(14) | 21.84 |

| SMA20 / SMA50 | 0.00 / 0.00 |

| Daily Volatility | 3.74% |

Shiba Inu — 1h candles, 7D window (SMA20/SMA50, RSI).