Sentiment: Neutral

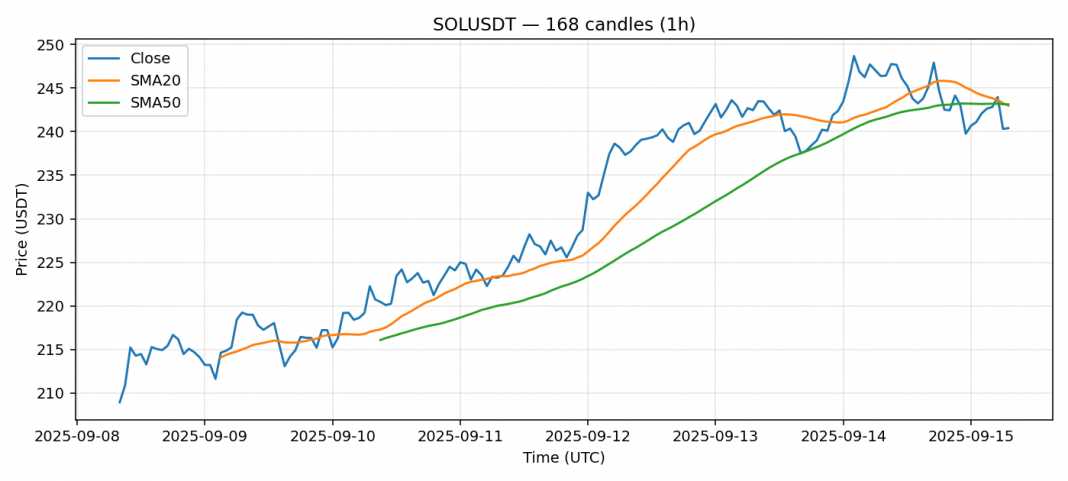

SOLUSDT is currently trading at $240.4, showing a slight decline of 2.74% over the past 24 hours. The RSI reading of 30.7 indicates the asset is in oversold territory, which often precedes a potential reversal or bounce. Both the 20-day SMA at $242.99 and 50-day SMA at $243.12 are acting as immediate resistance levels, with price trading just below these key averages. The 24-hour volume of $859M demonstrates healthy liquidity, while volatility remains moderate at 2.9%. Given the oversold conditions and proximity to major moving averages, I recommend watching for a break above $243 with volume confirmation for long entries. Downside support appears around the $235-238 zone. Consider scaling into positions gradually rather than full allocation at current levels.

Key Metrics

| Price | 240.4000 USDT |

| 24h Change | -2.74% |

| 24h Volume | 859618822.59 |

| RSI(14) | 30.72 |

| SMA20 / SMA50 | 242.99 / 243.12 |

| Daily Volatility | 2.91% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).