BlackRock, the world’s largest asset manager overseeing over $13.4 trillion in assets, has revealed that its spot Bitcoin exchange-traded funds have become the company’s most profitable product line. According to statements from the firm’s Brazil director, allocations for these cryptocurrency investment vehicles are approaching the $100 billion threshold, underscoring their significant contribution to BlackRock’s global revenue streams. The rapid accumulation of capital into these funds demonstrates growing institutional confidence in digital asset exposure through regulated financial instruments. This development marks a pivotal moment in the convergence of traditional finance and cryptocurrency markets, with BlackRock’s established market position lending credibility to Bitcoin investment products. The spot Bitcoin ETFs’ performance highlights evolving investor preferences toward accessible crypto asset vehicles within conventional portfolio strategies. As allocations continue to climb toward the $100 billion landmark, these products are reshaping how institutional and retail investors gain exposure to digital currencies through familiar investment frameworks.

BlackRock’s Spot Bitcoin ETFs Emerge as Top Revenue Driver with $100 Billion Milestone

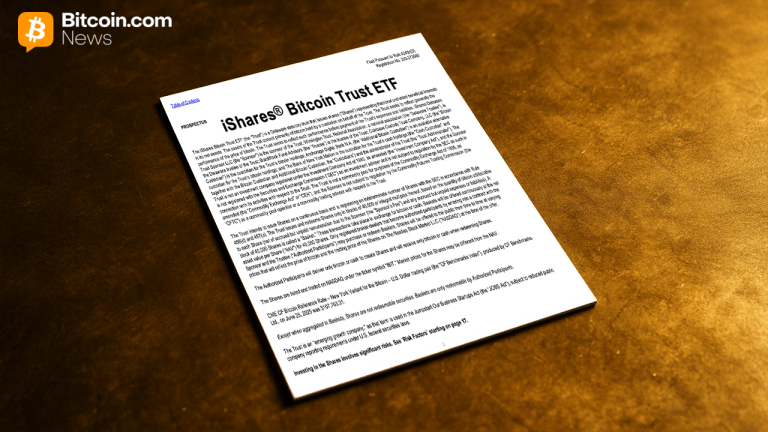

-