Sentiment: Neutral

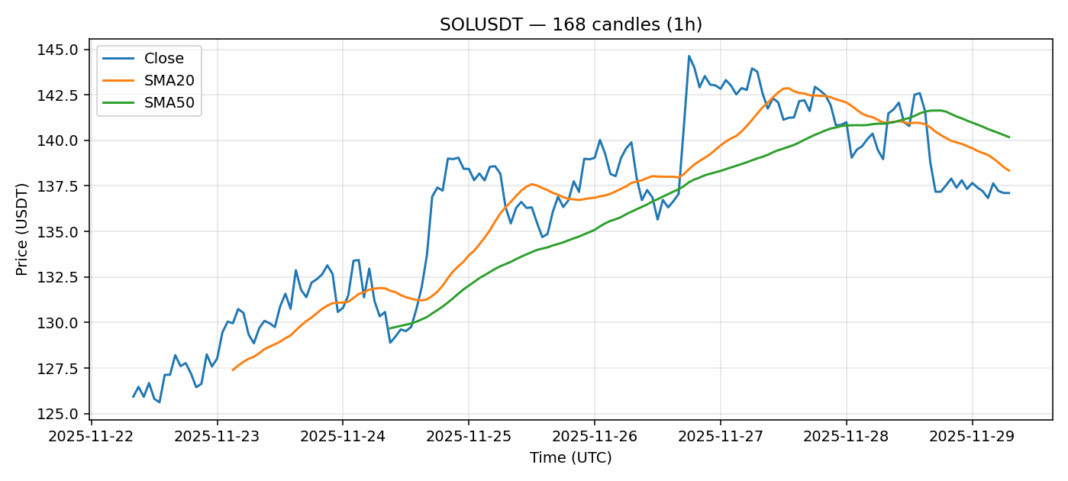

SOL is currently trading at $137.10, showing modest weakness with a 1.64% decline over the past 24 hours. The price sits just below both the 20-day SMA ($138.34) and 50-day SMA ($140.18), indicating near-term bearish pressure. However, the RSI at 49.24 suggests the asset is in neutral territory with no extreme overbought or oversold conditions. Trading volume remains substantial at $465 million, providing adequate liquidity. The 3.58% volatility reading indicates typical crypto market swings. For traders, current levels present a potential accumulation zone if SOL holds above $135 support. Consider scaling into positions with stops below $130, targeting a retest of the $145 resistance level. The convergence near key moving averages often precedes significant directional moves, so position sizing should remain conservative until a clearer trend emerges.

Key Metrics

| Price | 137.1000 USDT |

| 24h Change | -1.64% |

| 24h Volume | 464834523.43 |

| RSI(14) | 49.24 |

| SMA20 / SMA50 | 138.34 / 140.18 |

| Daily Volatility | 3.58% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).