Sentiment: Neutral

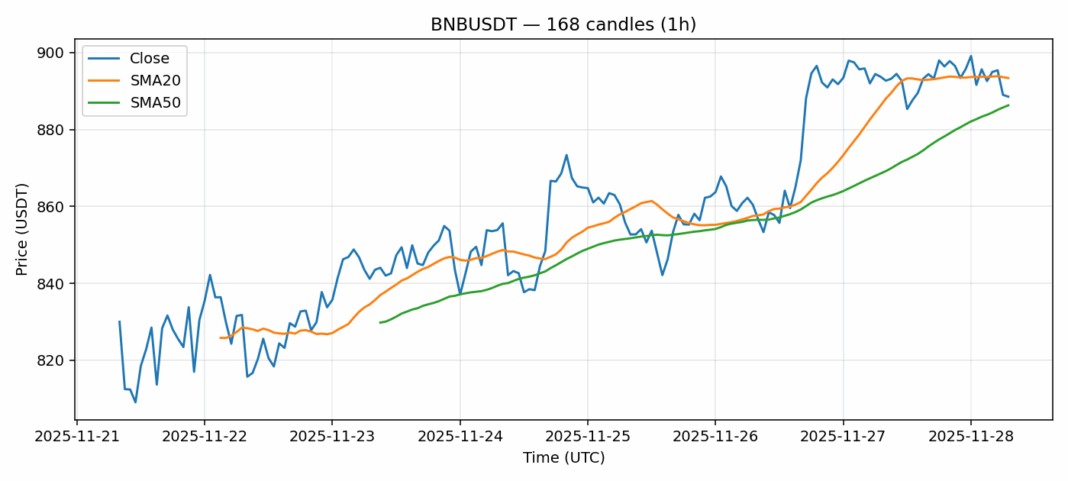

BNB is currently trading at $888.54, showing modest weakness with a 0.6% decline over the past 24 hours. The price finds itself in a technical tug-of-war, positioned between the 20-day SMA at $893.40 and the 50-day SMA at $886.28. This consolidation pattern suggests the market is searching for directional conviction. The RSI reading of 44.47 indicates neither overbought nor oversold conditions, providing room for movement in either direction. Trading volume of $107.7 million reflects moderate participation, while volatility remains contained at 3.1%. For traders, the key levels to watch are the 20-day SMA resistance above and 50-day SMA support below. A decisive break above $893 could signal renewed bullish momentum toward $900, while failure to hold $886 might trigger a test of lower support zones. Position sizing should remain conservative until clearer direction emerges.

Key Metrics

| Price | 888.5400 USDT |

| 24h Change | -0.60% |

| 24h Volume | 107685848.95 |

| RSI(14) | 44.47 |

| SMA20 / SMA50 | 893.40 / 886.28 |

| Daily Volatility | 3.09% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).