Sentiment: Neutral

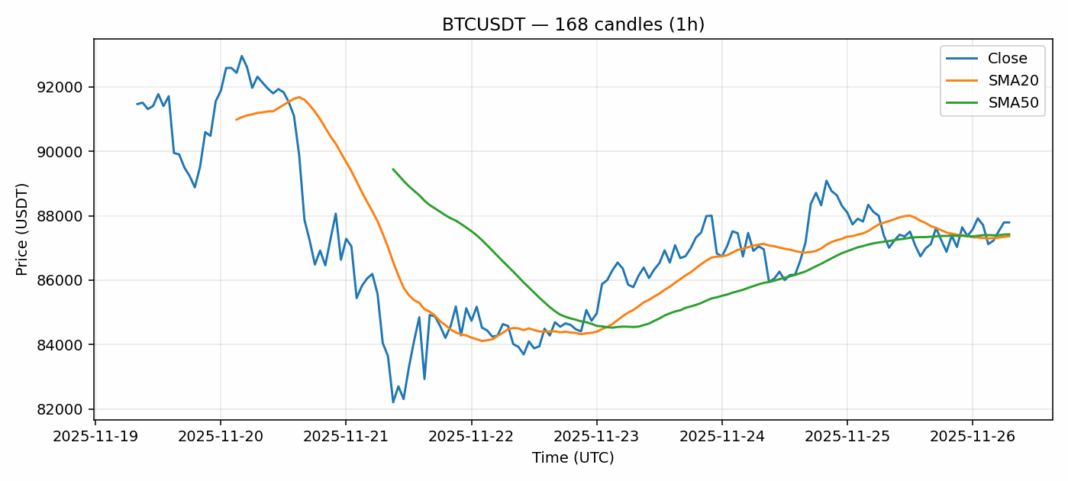

Bitcoin continues to consolidate around the $87,800 level after a modest 0.24% pullback over the past 24 hours. The current price action shows BTC trading just above both its 20-day SMA ($87,364) and 50-day SMA ($87,424), indicating underlying support remains intact despite the slight decline. The RSI reading of 51.87 suggests the asset is in neutral territory with neither overbought nor oversold conditions. Trading volume remains robust at $1.69 billion, supporting the current price levels. The 3.28% volatility reading indicates relatively stable conditions compared to Bitcoin’s typical swings. For traders, this consolidation phase presents potential accumulation opportunities near key moving average support. A break above $88,000 could signal renewed bullish momentum, while failure to hold the $87,300 support zone might trigger a deeper correction. Position sizing should remain conservative given the tight trading range.

Key Metrics

| Price | 87794.0000 USDT |

| 24h Change | -0.24% |

| 24h Volume | 1693170876.82 |

| RSI(14) | 51.87 |

| SMA20 / SMA50 | 87364.26 / 87424.52 |

| Daily Volatility | 3.28% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).