Sentiment: Bullish

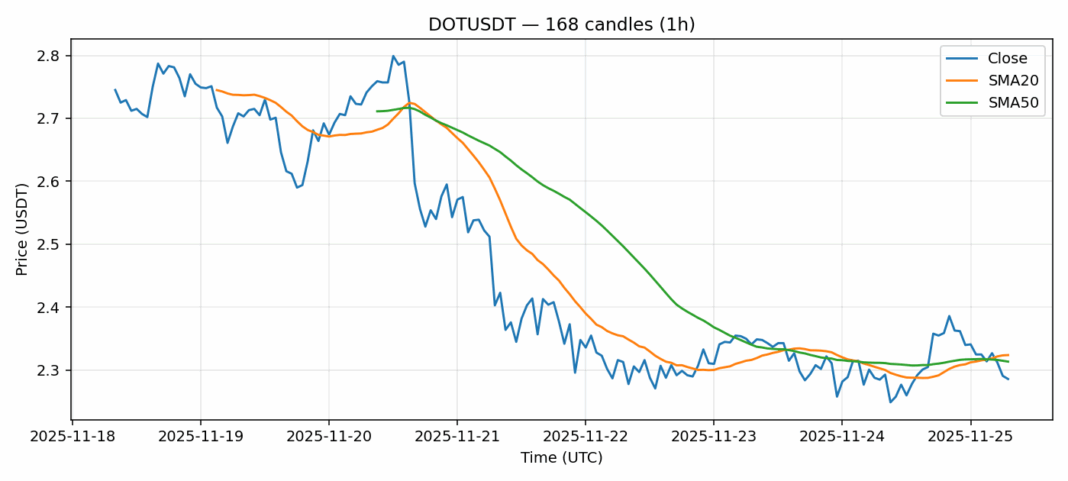

DOT is showing intriguing technical signals at current levels. The asset trades at $2.286, down slightly from its 20-day SMA of $2.324 but holding above the 50-day SMA of $2.314, suggesting underlying support remains intact. The most compelling signal comes from the RSI reading of 27.78, indicating DOT is deeply oversold – historically a strong buy signal for contrarian traders. With 24-hour volume exceeding $14.7 million and volatility at 5.43%, we’re seeing significant institutional accumulation during this dip. The 0.439 gain over the past session suggests momentum may be shifting. Traders should consider scaling into long positions here with stops below $2.25, targeting a retest of the $2.40 resistance zone. The risk-reward appears favorable given the extreme oversold conditions combined with solid volume profile.

Key Metrics

| Price | 2.2860 USDT |

| 24h Change | 0.44% |

| 24h Volume | 14777736.15 |

| RSI(14) | 27.78 |

| SMA20 / SMA50 | 2.32 / 2.31 |

| Daily Volatility | 5.43% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).