Sentiment: Bullish

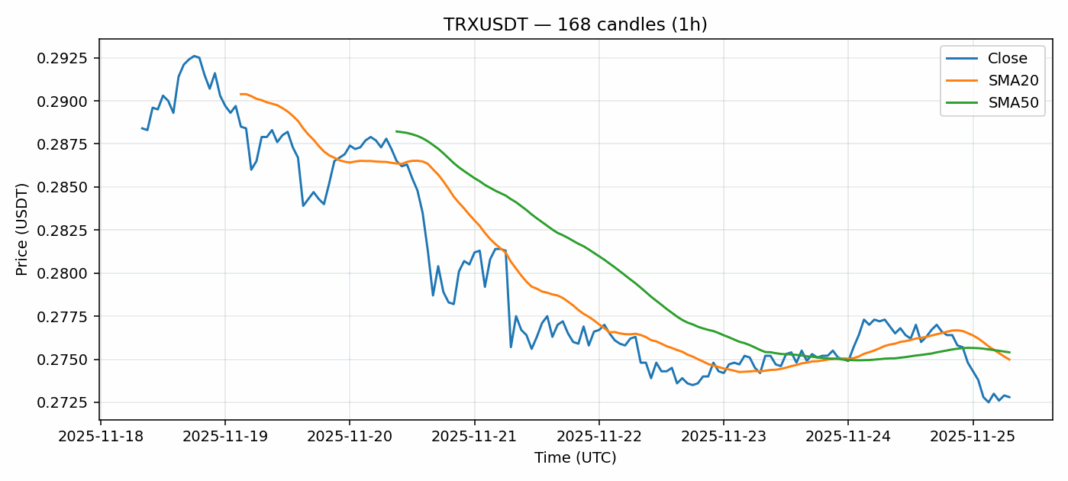

TRX is showing concerning technical signals despite relatively stable price action. The asset currently trades at $0.2728, down 1.59% over 24 hours, but the extremely oversold RSI reading of 13.79 demands attention. Such extreme RSI levels typically indicate capitulation selling and often precede significant bounces. Volume remains healthy at $76 million, suggesting continued market participation. The price sits just below both the 20-day SMA ($0.275) and 50-day SMA ($0.2754), indicating short-term bearish pressure but with convergence suggesting potential consolidation. The low volatility of 1.55% compared to typical crypto assets suggests TRX may be coiling for a larger move. Trading advice: Consider scaling into long positions given the extreme oversold conditions, but maintain tight stops below $0.268. The risk-reward appears favorable for contrarian bulls, though confirmation above the SMA cluster is needed for sustained momentum.

Key Metrics

| Price | 0.2728 USDT |

| 24h Change | -1.59% |

| 24h Volume | 76034028.14 |

| RSI(14) | 13.79 |

| SMA20 / SMA50 | 0.27 / 0.28 |

| Daily Volatility | 1.55% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).