Sentiment: Bullish

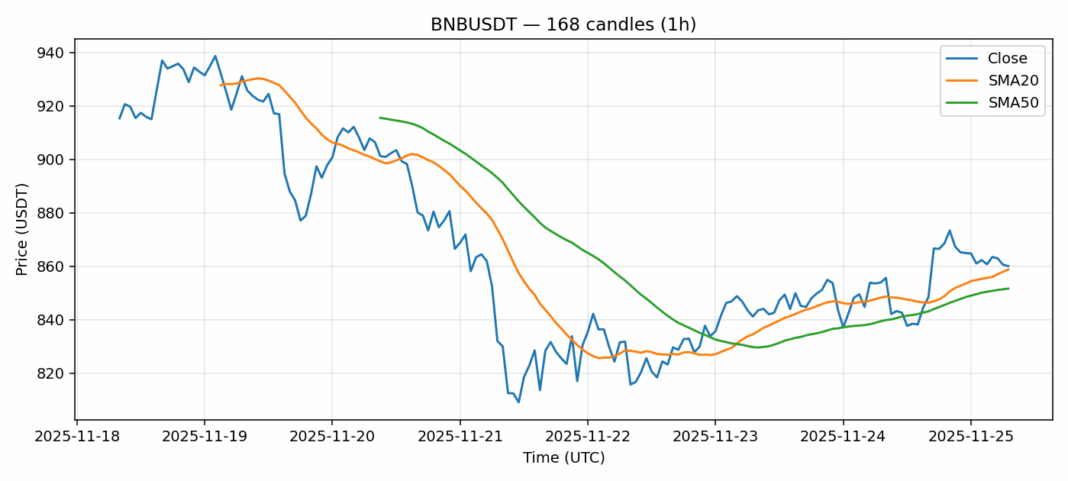

BNB is showing resilience at the $860 level, trading marginally above its 20-day SMA of $858.79 while holding well above the 50-day SMA at $851.63. The 0.91% 24-hour gain suggests accumulation despite broader market uncertainty. With RSI at 38.35, BNB remains in oversold territory, indicating potential for upward momentum if buying pressure materializes. The $850-860 zone appears to be forming a crucial support cluster, combining both moving averages and psychological levels. Trading volume of $183 million demonstrates healthy liquidity, though volatility remains elevated at 3.56%. Traders should watch for a decisive break above $870 to confirm bullish continuation, with stops ideally placed below $845. The current setup favors accumulation for medium-term positions, targeting $890-900 resistance zones. Risk management remains crucial given the elevated volatility environment.

Key Metrics

| Price | 860.0700 USDT |

| 24h Change | 0.91% |

| 24h Volume | 182983429.70 |

| RSI(14) | 38.35 |

| SMA20 / SMA50 | 858.79 / 851.63 |

| Daily Volatility | 3.56% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).