Sentiment: Bullish

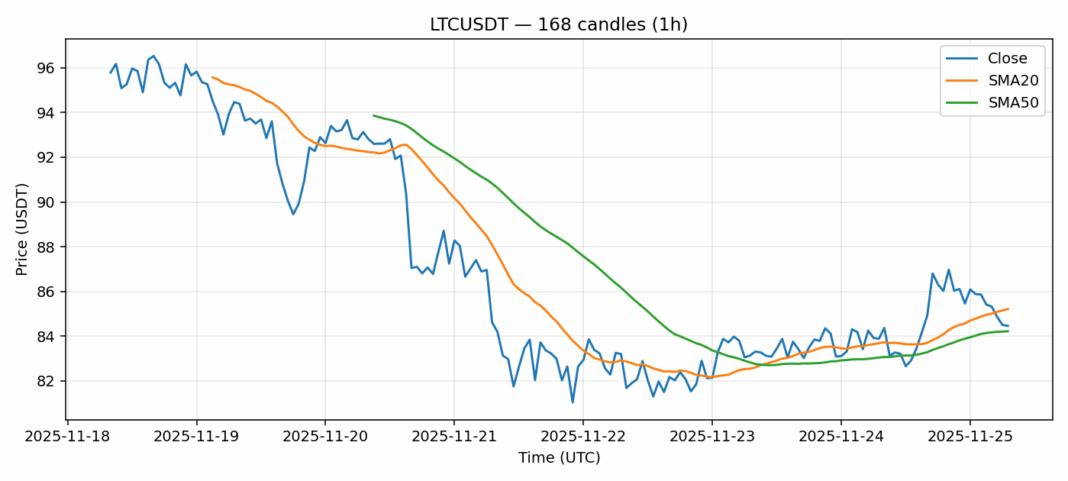

Litecoin is showing intriguing technical signals as it trades at $84.46, displaying modest 0.84% gains amid elevated volatility. The cryptocurrency finds itself in a critical technical juncture, trading slightly below the 20-day SMA at $85.21 but holding above the 50-day SMA at $84.22, suggesting potential support consolidation. Most notably, the RSI reading of 29.33 indicates severely oversold conditions, historically preceding significant bounce opportunities. Daily volume of $40.9 million demonstrates healthy market participation despite recent price pressure. Traders should watch for a decisive break above the $85.20 resistance level, which could trigger short-term momentum toward the $88-90 range. Risk management remains crucial given the 4.34% volatility reading. Consider scaling into long positions with tight stops below $82.50, while aggressive traders might find current levels attractive for mean reversion plays given the extreme RSI reading.

Key Metrics

| Price | 84.4600 USDT |

| 24h Change | 0.84% |

| 24h Volume | 40993176.41 |

| RSI(14) | 29.33 |

| SMA20 / SMA50 | 85.21 / 84.22 |

| Daily Volatility | 4.34% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).