Sentiment: Neutral

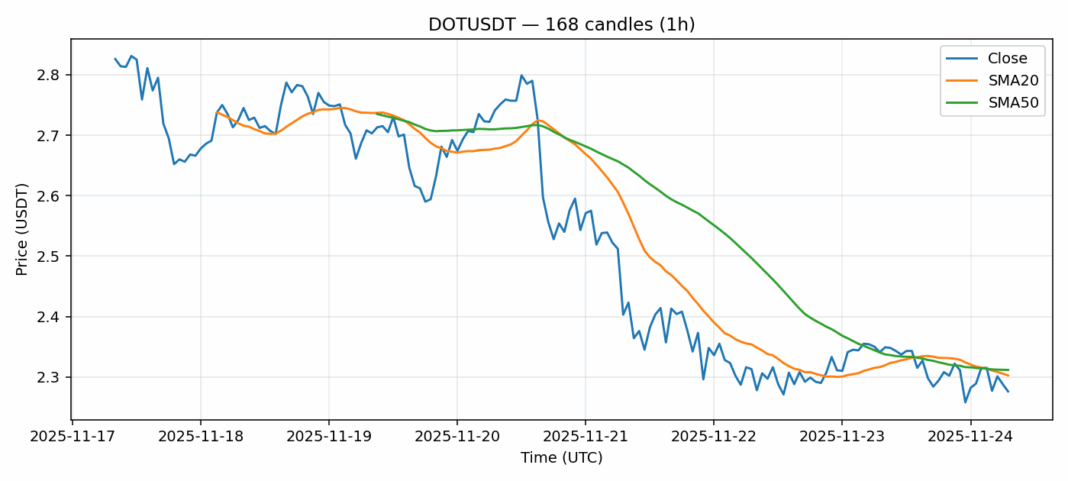

DOT faces near-term headwinds as price hovers at $2.276, trading below both the 20-day SMA ($2.302) and 50-day SMA ($2.312), indicating persistent selling pressure. The 3.1% decline over 24 hours coupled with elevated volatility of 5.57% suggests continued uncertainty. However, the RSI reading of 48.45 shows DOT is approaching oversold territory without being extreme, potentially setting up for a technical bounce. Trading volume remains healthy at $13.5 million, indicating sustained interest despite the downturn. Traders should watch for consolidation above the $2.25 support level – a break below could trigger further declines toward $2.15. For position traders, accumulating near current levels with tight stops below $2.20 offers favorable risk-reward, while swing traders might wait for RSI confirmation above 50 and a break above the 20-day SMA before entering long positions. The current setup suggests cautious accumulation rather than aggressive positioning.

Key Metrics

| Price | 2.2760 USDT |

| 24h Change | -3.11% |

| 24h Volume | 13519126.21 |

| RSI(14) | 48.45 |

| SMA20 / SMA50 | 2.30 / 2.31 |

| Daily Volatility | 5.57% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).