Sentiment: Neutral

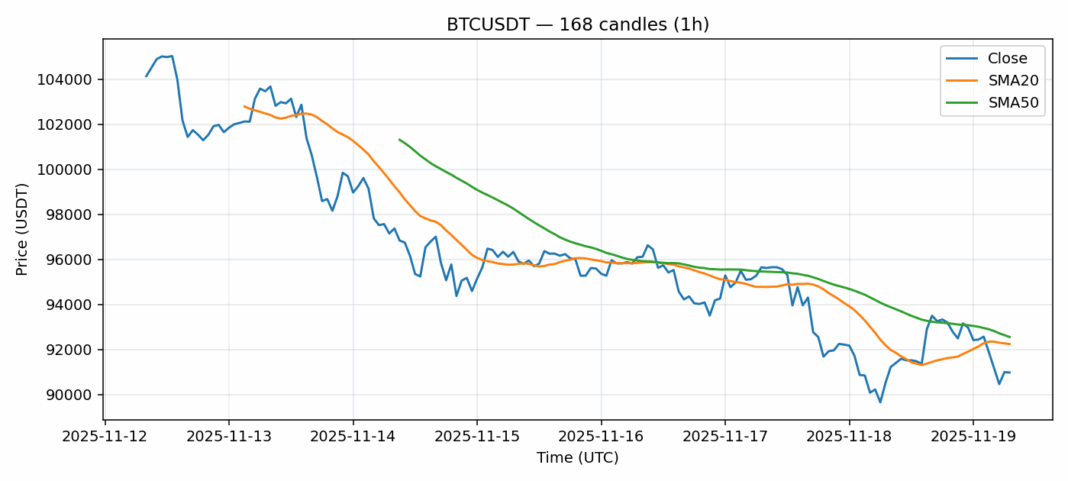

Bitcoin is currently trading at $90,976 after posting modest 1.47% gains over the past 24 hours. The technical picture reveals significant oversold conditions with the RSI plunging to 27.78, well below the traditional 30 oversold threshold. This extreme reading suggests potential for a technical bounce in the near term. However, BTC continues trading below both its 20-day SMA ($92,242) and 50-day SMA ($92,554), indicating persistent bearish pressure in the medium term. The $91,000 level appears to be acting as psychological resistance while volume remains substantial at $2.77 billion, showing continued institutional interest despite the price weakness. Traders should watch for a break above the $92,500 SMA confluence zone for confirmation of trend reversal. Current volatility at 2.78% provides decent swing trading opportunities. Consider scaling into long positions on dips toward $89,000 with tight stops, while aggressive traders might short rallies toward the $92,500 resistance area.

Key Metrics

| Price | 90976.3200 USDT |

| 24h Change | 1.47% |

| 24h Volume | 2768652975.59 |

| RSI(14) | 27.78 |

| SMA20 / SMA50 | 92241.68 / 92553.80 |

| Daily Volatility | 2.78% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).