Sentiment: Neutral

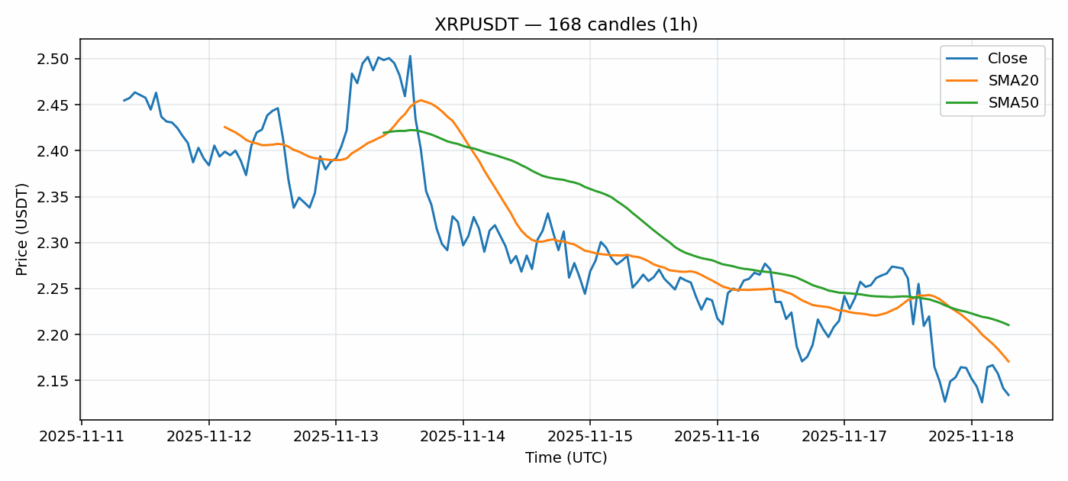

XRP is showing signs of consolidation after a sharp 5.65% decline over the past 24 hours, currently trading at $2.13. The RSI reading of 41.79 indicates the asset is approaching oversold territory, though it hasn’t yet reached the traditional 30-level threshold that typically signals a buying opportunity. Technical positioning shows XRP trading below both its 20-day SMA ($2.17) and 50-day SMA ($2.21), suggesting near-term bearish momentum remains intact. However, the substantial 24-hour trading volume exceeding $532 million indicates significant institutional interest at these levels. Traders should watch for a decisive break above the $2.17 resistance level for potential long entries, while maintaining stop-losses below $2.10. The current volatility of 4.17% presents both risk and opportunity – position sizing should reflect the elevated uncertainty. Given the oversold RSI conditions and strong volume support, we may see a technical bounce toward the $2.20-$2.25 resistance zone in coming sessions.

Key Metrics

| Price | 2.1343 USDT |

| 24h Change | -5.65% |

| 24h Volume | 532169648.93 |

| RSI(14) | 41.79 |

| SMA20 / SMA50 | 2.17 / 2.21 |

| Daily Volatility | 4.17% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).