Sentiment: Neutral

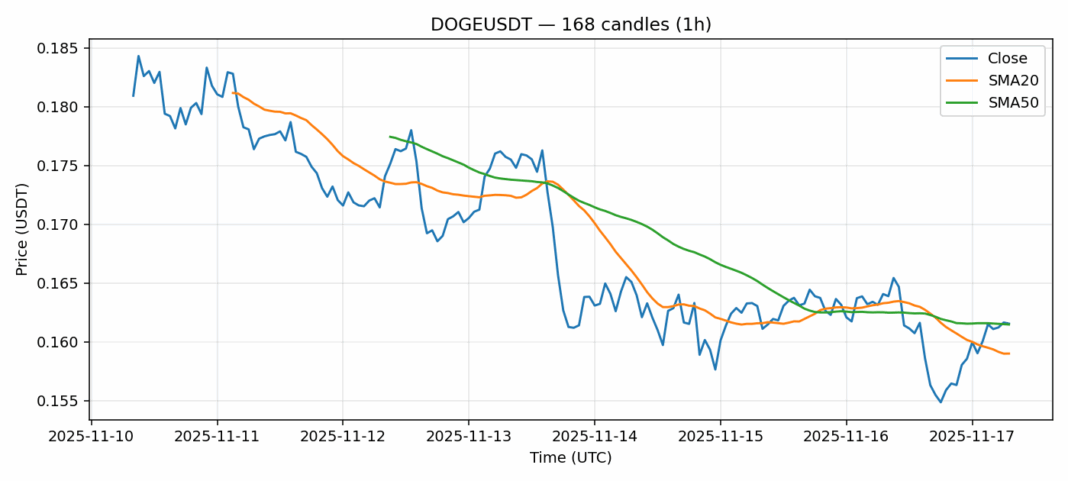

DOGE is showing mixed signals as it trades at $0.16155, down slightly by 1.06% over the past 24 hours. The technical picture reveals concerning overbought conditions with RSI sitting at 79, well above the traditional 70 threshold that signals potential exhaustion. However, the price remains above both the 20-day SMA ($0.159) and 50-day SMA ($0.16148), indicating underlying support remains intact. Trading volume of $183 million suggests decent participation, though the 4.15% volatility reading highlights DOGE’s characteristic price swings. For traders, caution is warranted given the extreme RSI levels – consider taking partial profits on any rallies toward $0.165-0.168 resistance. Support appears firm around $0.158-0.159, where the 20-day SMA converges with recent consolidation levels. Position sizing should remain conservative until we see either a healthy pullback to reset overbought conditions or a decisive break above $0.165 with sustained volume.

Key Metrics

| Price | 0.1615 USDT |

| 24h Change | -1.06% |

| 24h Volume | 182945894.94 |

| RSI(14) | 79.04 |

| SMA20 / SMA50 | 0.16 / 0.16 |

| Daily Volatility | 4.15% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).