Sentiment: Neutral

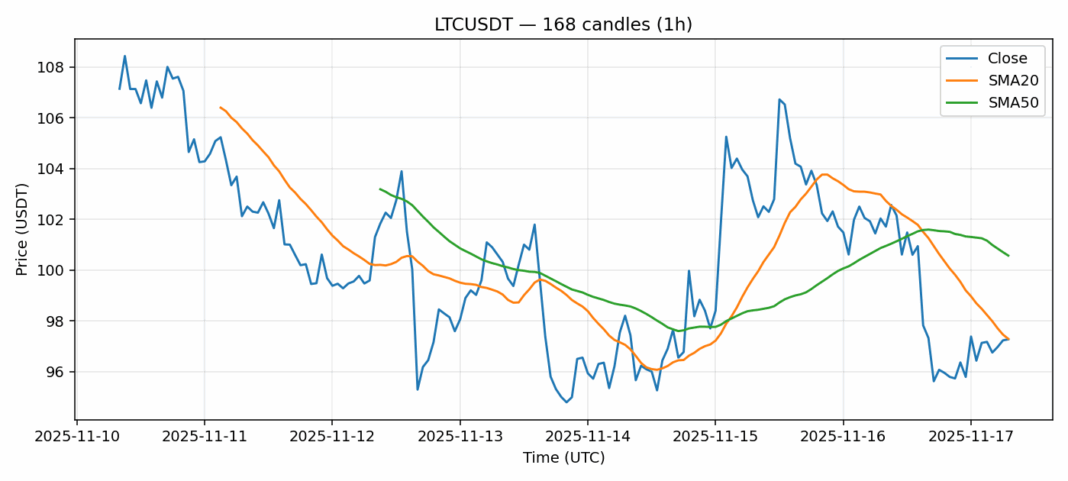

LTCUSDT is showing intriguing technical dynamics as it hovers near the $97.28 level, virtually identical to its 20-day SMA of $97.29. This suggests a critical inflection point where bulls and bears are in equilibrium. The 4.15% decline over 24 hours appears concerning, but the RSI reading of 63.29 indicates there’s still room for upward momentum before reaching overbought territory. More importantly, LTC continues to demonstrate robust trading activity with $68.9 million in daily volume, signaling sustained market interest despite the price dip. The current price sitting below the 50-day SMA at $100.57 presents a potential resistance level that traders should monitor closely. Given the moderate volatility of 5.24%, I’d recommend accumulation on any dips toward $95 support with tight stop-losses. The convergence around the 20-day SMA often precedes significant directional moves – watch for a decisive break above $98.50 for confirmation of bullish continuation.

Key Metrics

| Price | 97.2800 USDT |

| 24h Change | -4.15% |

| 24h Volume | 68948431.14 |

| RSI(14) | 63.29 |

| SMA20 / SMA50 | 97.29 / 100.57 |

| Daily Volatility | 5.24% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).