Sentiment: Neutral

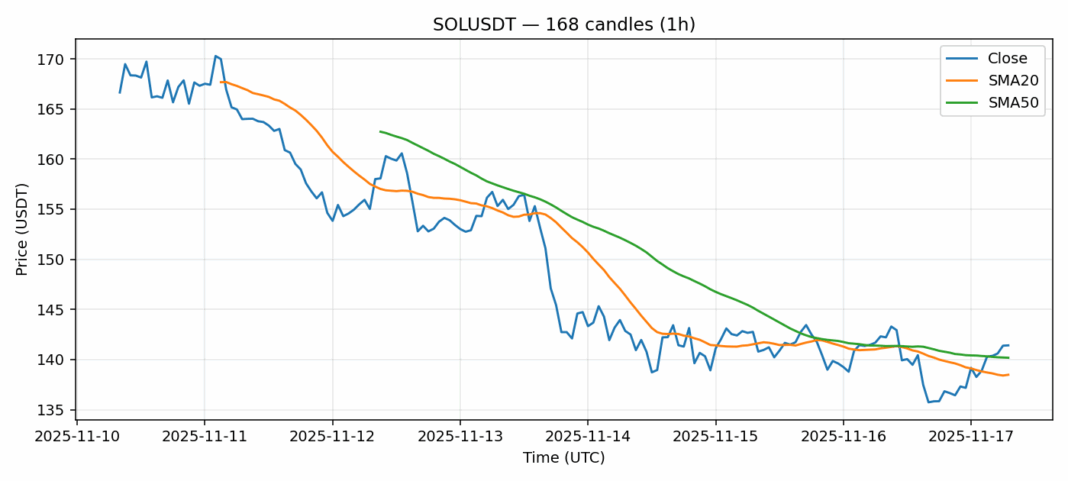

SOL is showing mixed signals as it trades at $141.41, down slightly by 0.12% over the past 24 hours. The concerning technical indicator is the RSI reading of 82.9, which places SOL in severely overbought territory and suggests a potential pullback is imminent. However, the price remains above both the 20-day SMA ($138.48) and 50-day SMA ($140.17), indicating the underlying trend remains intact. The substantial 24-hour trading volume of $521 million demonstrates strong market participation, while the 4.37% volatility reading suggests relatively stable price action for a cryptocurrency. Traders should consider taking partial profits given the extreme RSI levels while maintaining core positions for the ongoing uptrend. A break below the $138 support level could signal a deeper correction toward $130. For new entries, waiting for a pullback to the $135-138 zone would provide better risk-reward opportunities.

Key Metrics

| Price | 141.4100 USDT |

| 24h Change | -0.12% |

| 24h Volume | 521373578.02 |

| RSI(14) | 82.90 |

| SMA20 / SMA50 | 138.48 / 140.17 |

| Daily Volatility | 4.37% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).