Sentiment: Neutral

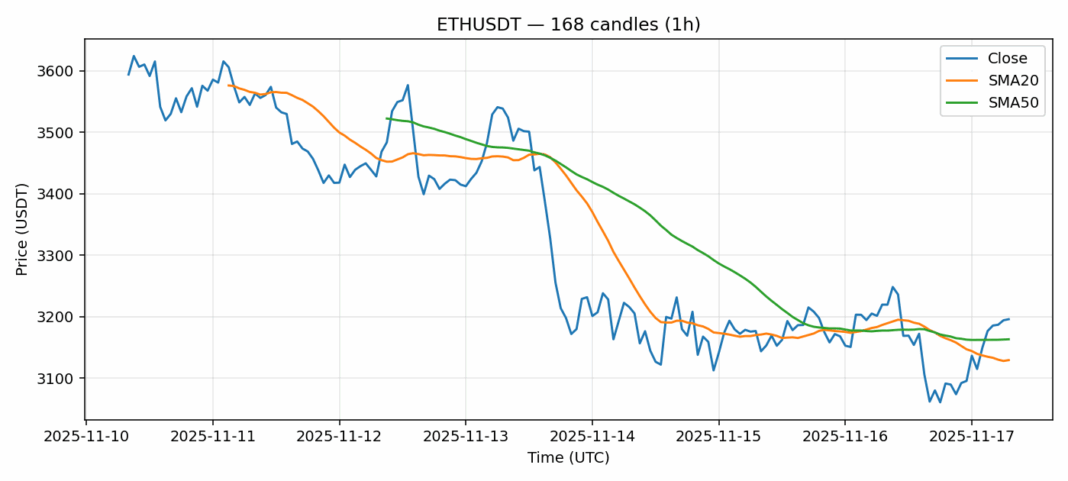

Ethereum continues to trade in a tight range around $3,195, showing resilience despite a minor 0.16% dip over the past 24 hours. The current price action finds ETH positioned above its 20-day SMA at $3,129 but slightly below the 50-day SMA at $3,163, suggesting potential consolidation ahead. The elevated RSI reading of 74.88 indicates overbought conditions, which could trigger a short-term pullback toward the $3,100-$3,130 support zone. Trading volume remains robust at nearly $1.94 billion, confirming active institutional participation. Volatility at 4.14% suggests relatively stable price action compared to typical crypto swings. Traders should consider taking partial profits near current levels while maintaining core positions. For new entries, waiting for a dip toward the $3,050-$3,100 range would provide better risk-reward opportunities. The overall structure remains constructive, but patience is warranted given the overextended technical readings.

Key Metrics

| Price | 3195.7600 USDT |

| 24h Change | -0.16% |

| 24h Volume | 1939925093.35 |

| RSI(14) | 74.88 |

| SMA20 / SMA50 | 3129.12 / 3163.05 |

| Daily Volatility | 4.14% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).