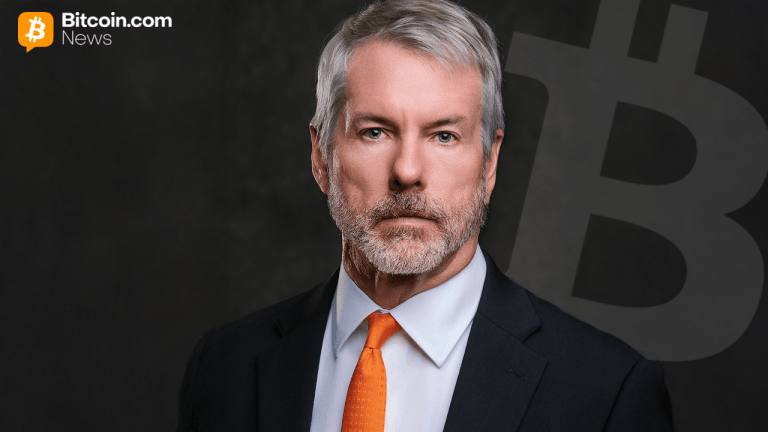

MicroStrategy Executive Chairman Michael Saylor has asserted that Bitcoin has established a market floor, indicating that the cryptocurrency has stabilized following recent volatility. In a recent interview with real estate magnate Grant Cardone, Saylor emphasized that the majority of forced liquidation selling has been eliminated from the trading ecosystem, allowing for more stable price discovery.

The prominent Bitcoin advocate explained that the market has successfully weathered the storm of margin calls and leveraged position unwinding that characterized recent trading sessions. Saylor’s analysis suggests that the digital asset market has reached an equilibrium point where organic buying and selling activity can resume without the overwhelming influence of distressed selling pressure.

This perspective from one of Bitcoin’s most vocal institutional proponents comes as the cryptocurrency market shows signs of consolidation after a period of significant price fluctuations. Saylor’s comments reflect growing confidence among long-term Bitcoin holders that the worst of the recent market turbulence has passed, potentially setting the stage for renewed institutional interest and capital allocation to digital assets.

Market analysts are closely monitoring whether this assessment aligns with broader trading patterns and institutional flow data, particularly as global macroeconomic conditions continue to influence cryptocurrency valuations.