Sentiment: Neutral

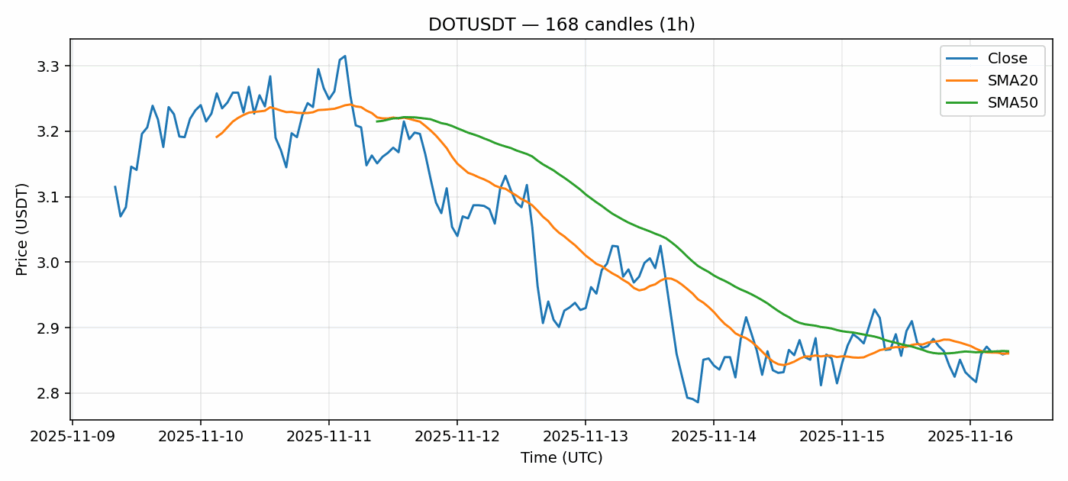

DOT is showing consolidation around the $2.86 level after a modest 2.12% pullback over the past 24 hours. The current price sits almost perfectly between the 20-day SMA ($2.86055) and 50-day SMA ($2.86404), indicating a critical inflection point. With RSI at 44.5, DOT remains in neutral territory but approaching oversold conditions, suggesting potential for a bounce if buyers step in. The 24-hour volume of $12.4 million demonstrates decent liquidity, while volatility under 5% points to relative stability. Traders should watch for a decisive break above the 50-day SMA for bullish confirmation, targeting $3.00 resistance. Conversely, failure to hold the 20-day SMA could see a test of $2.75 support. Position sizing should remain conservative until clearer directional momentum emerges. Consider dollar-cost averaging on dips toward $2.80 for longer-term accumulation.

Key Metrics

| Price | 2.8620 USDT |

| 24h Change | -2.12% |

| 24h Volume | 12407851.19 |

| RSI(14) | 44.50 |

| SMA20 / SMA50 | 2.86 / 2.86 |

| Daily Volatility | 4.97% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).