Sentiment: Bullish

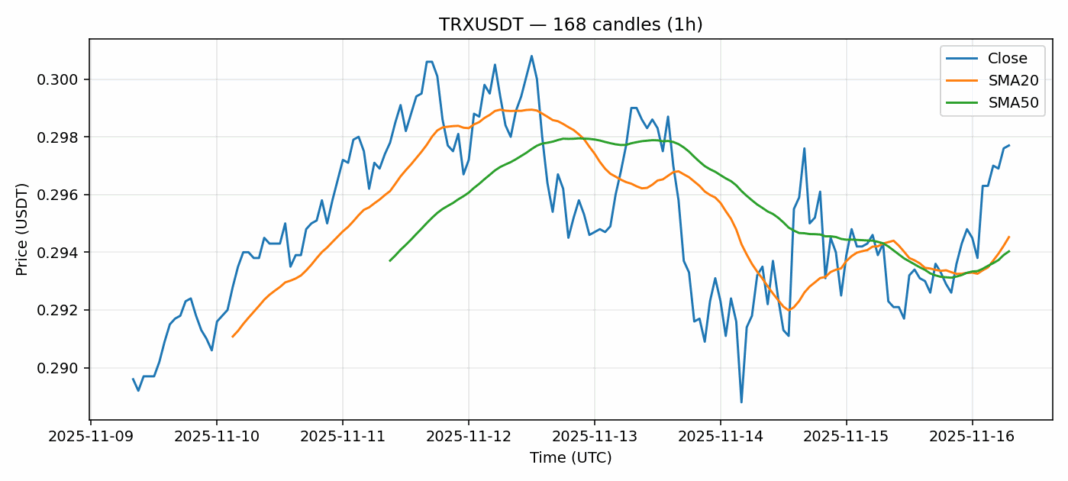

TRX is showing strong momentum with a 1.33% gain over the past 24 hours, currently trading at $0.2977 against significant volume of $64.3 million. The RSI reading of 74.7 indicates overbought conditions, suggesting potential for a near-term pullback. Price remains above both the 20-day SMA ($0.2945) and 50-day SMA ($0.294), confirming the bullish trend structure. However, traders should exercise caution given the elevated volatility reading of 1.65%. For short-term positions, consider waiting for a dip toward the $0.294 support zone before entering. Longer-term holders might maintain positions but implement stop-losses around $0.292 to protect gains. The substantial volume indicates genuine institutional interest, though the overbought RSI warrants careful position sizing.

Key Metrics

| Price | 0.2977 USDT |

| 24h Change | 1.33% |

| 24h Volume | 64360650.55 |

| RSI(14) | 74.70 |

| SMA20 / SMA50 | 0.29 / 0.29 |

| Daily Volatility | 1.65% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).