Sentiment: Neutral

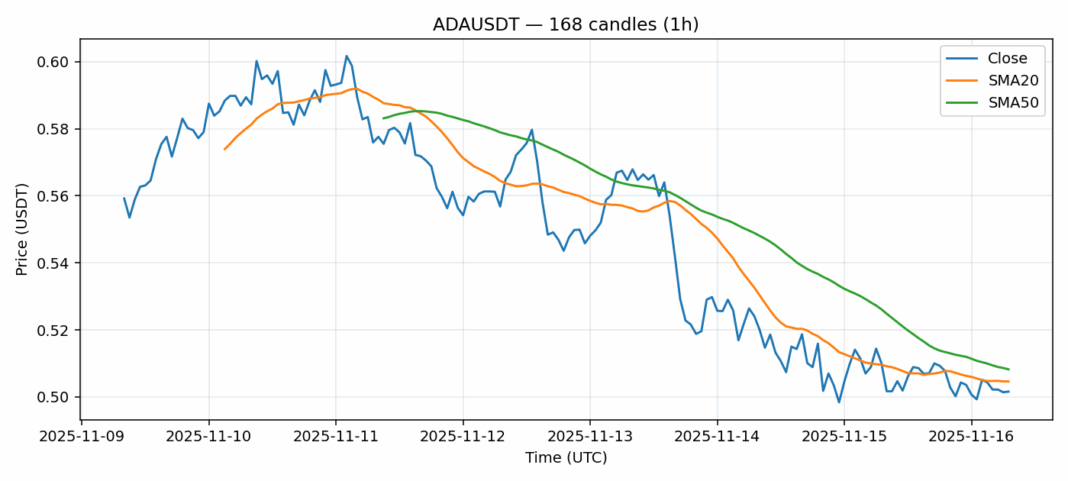

ADA is showing signs of potential capitulation as it trades at $0.5016, down 2.28% over 24 hours. The RSI reading of 35.3 indicates oversold conditions, suggesting selling pressure may be exhausting. While ADA remains below both its 20-day SMA ($0.5046) and 50-day SMA ($0.5082), the proximity to these key moving averages presents a critical juncture. Trading volume of $44.8 million shows moderate participation, while volatility remains elevated at 4.33%. For traders, current levels offer potential accumulation opportunities with tight stop-losses below $0.4950. A break above the 20-day SMA could trigger short-term momentum toward $0.5150 resistance. However, the broader market sentiment remains cautious, so position sizing should remain conservative until clearer directional momentum emerges. Watch for volume confirmation on any upward moves.

Key Metrics

| Price | 0.5016 USDT |

| 24h Change | -2.28% |

| 24h Volume | 44879281.51 |

| RSI(14) | 35.31 |

| SMA20 / SMA50 | 0.50 / 0.51 |

| Daily Volatility | 4.33% |

Cardano — 1h candles, 7D window (SMA20/SMA50, RSI).