Sentiment: Neutral

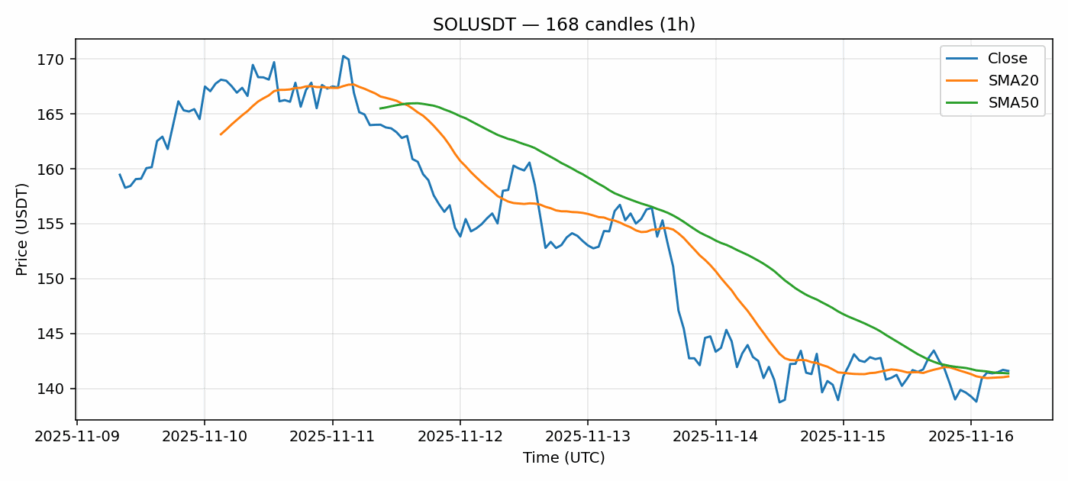

SOL is showing consolidation around the $141.50 level after a modest 0.7% decline over the past 24 hours. The current price sits just above the 20-day SMA ($141.07) but below the 50-day SMA ($141.36), indicating near-term indecision in the market. With RSI at 40.25, SOL is approaching oversold territory, suggesting potential for a bounce if buying pressure emerges. The 24-hour trading volume of $309 million demonstrates healthy liquidity, while volatility remains moderate at 4.3%. Traders should watch for a decisive break above the $142 resistance level for bullish confirmation, with support likely forming around $138. Consider scaling into long positions on dips toward $139 with tight stops, while aggressive traders might short rallies toward $143 if momentum falters. The current setup favors range-bound trading until clearer directional momentum emerges.

Key Metrics

| Price | 141.5900 USDT |

| 24h Change | -0.71% |

| 24h Volume | 309284237.81 |

| RSI(14) | 40.25 |

| SMA20 / SMA50 | 141.07 / 141.36 |

| Daily Volatility | 4.29% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).