Sentiment: Neutral

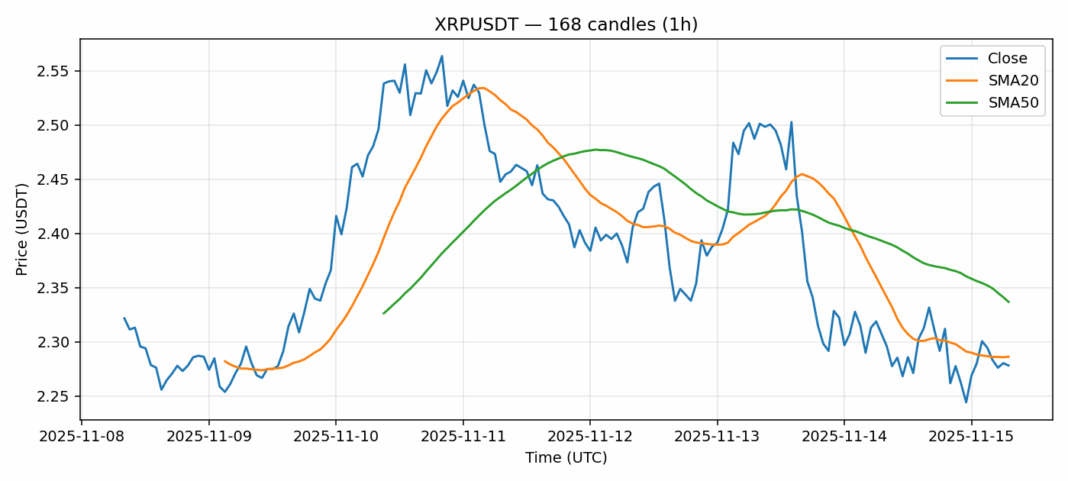

XRP is showing signs of consolidation after recent weakness, trading at $2.2784 with a modest 1.55% decline over the past 24 hours. The current price sits just below the 20-day SMA of $2.286, indicating near-term resistance, while the 50-day SMA at $2.337 continues to provide overhead pressure. The RSI reading of 42.79 suggests XRP is approaching oversold territory but hasn’t reached extreme levels yet. Trading volume remains substantial at $420 million, showing continued institutional interest despite the price dip. Volatility remains elevated at 4%, typical for XRP during consolidation phases. For traders, current levels present potential accumulation opportunities with tight stop losses below $2.25. A break above the 20-day SMA could signal momentum returning toward the $2.40 resistance zone. However, failure to hold current support may see a retest of the $2.20 level. Position sizing should remain conservative given the ongoing regulatory uncertainty surrounding XRP.

Key Metrics

| Price | 2.2784 USDT |

| 24h Change | -1.55% |

| 24h Volume | 420361552.09 |

| RSI(14) | 42.79 |

| SMA20 / SMA50 | 2.29 / 2.34 |

| Daily Volatility | 4.00% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).