Sentiment: Neutral

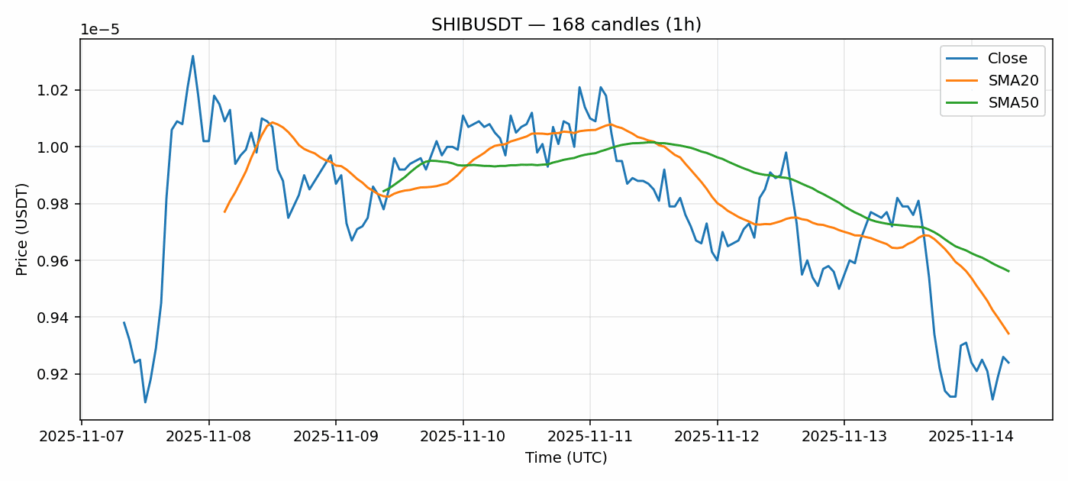

SHIB/USDT is showing signs of consolidation after recent selling pressure, currently trading at $0.00000925 with a 5.4% decline over the past 24 hours. The meme token finds itself in a technical tug-of-war, trading below both its 20-day SMA ($0.00000934) and 50-day SMA ($0.00000956), indicating near-term bearish momentum. However, the RSI reading of 44 suggests the asset is approaching oversold territory, potentially setting up for a relief rally. Volume remains healthy at $12.3 million, indicating continued trader interest despite the price decline. The 4.2% volatility reading shows SHIB maintaining its characteristic price swings, though moderated from recent extremes. Traders should watch for a break above the 20-day SMA as a potential bullish signal, while a failure to hold current levels could see a test of stronger support zones. Given the technical setup, cautious accumulation on dips with tight stop-losses appears prudent for risk-tolerant traders.

Key Metrics

| Price | 0.0000 USDT |

| 24h Change | -5.42% |

| 24h Volume | 12384365.29 |

| RSI(14) | 44.19 |

| SMA20 / SMA50 | 0.00 / 0.00 |

| Daily Volatility | 4.21% |

Shiba Inu — 1h candles, 7D window (SMA20/SMA50, RSI).