Sentiment: Bearish

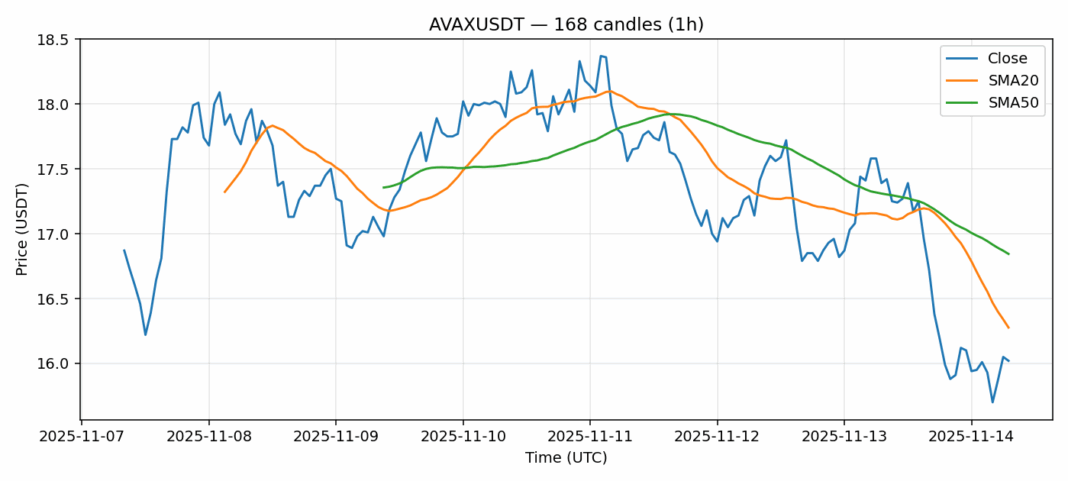

AVAX is showing significant weakness in today’s trading, down over 9% against USDT to $16.02 as selling pressure intensifies. The current price has broken below both the 20-day SMA ($16.28) and 50-day SMA ($16.84), indicating bearish momentum in the short to medium term. With RSI sitting at 39.29, AVAX is approaching oversold territory but hasn’t reached extreme levels yet. The elevated volatility of 4.59% suggests continued price swings are likely. Trading volume remains substantial at $65 million, confirming genuine selling interest rather than thin market conditions. For traders, this breakdown below key moving averages suggests caution is warranted. Consider waiting for RSI to dip below 30 for potential oversold bounce opportunities, or look for consolidation above $15.50 before considering long positions. Resistance now sits at the $16.28-16.84 SMA cluster, while sustained breaks below $15.50 could trigger further declines toward $14 support.

Key Metrics

| Price | 16.0200 USDT |

| 24h Change | -9.03% |

| 24h Volume | 65181247.98 |

| RSI(14) | 39.29 |

| SMA20 / SMA50 | 16.28 / 16.84 |

| Daily Volatility | 4.59% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).