Sentiment: Neutral

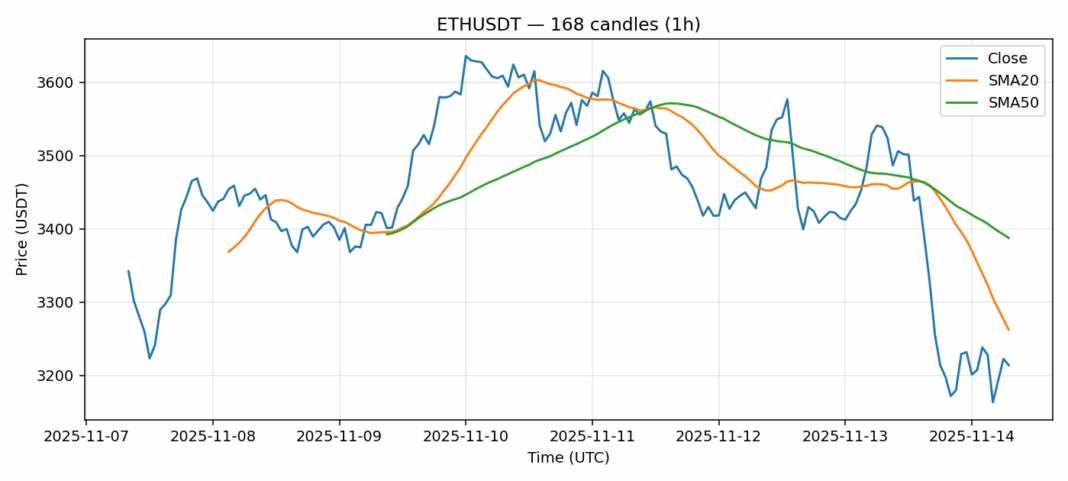

Ethereum is currently trading at $3,213, showing moderate weakness with a 2.9% decline over the past 24 hours. The price sits below both the 20-day SMA ($3,262) and 50-day SMA ($3,387), indicating near-term bearish pressure. However, the RSI reading of 44 suggests ETH is approaching oversold territory without being severely extended. Trading volume remains robust at $3.4 billion, indicating active participation despite the downward move. The current volatility of 3.7% presents both risk and opportunity for traders. For position traders, accumulating near $3,200 with stops below $3,150 could offer favorable risk-reward, while swing traders might wait for a confirmed break above the 20-day SMA before entering long positions. The key resistance to watch remains the $3,260-3,300 zone, where we’d expect significant selling pressure.

Key Metrics

| Price | 3213.0000 USDT |

| 24h Change | -9.30% |

| 24h Volume | 3399131041.44 |

| RSI(14) | 44.10 |

| SMA20 / SMA50 | 3262.10 / 3387.51 |

| Daily Volatility | 3.69% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).