Sentiment: Neutral

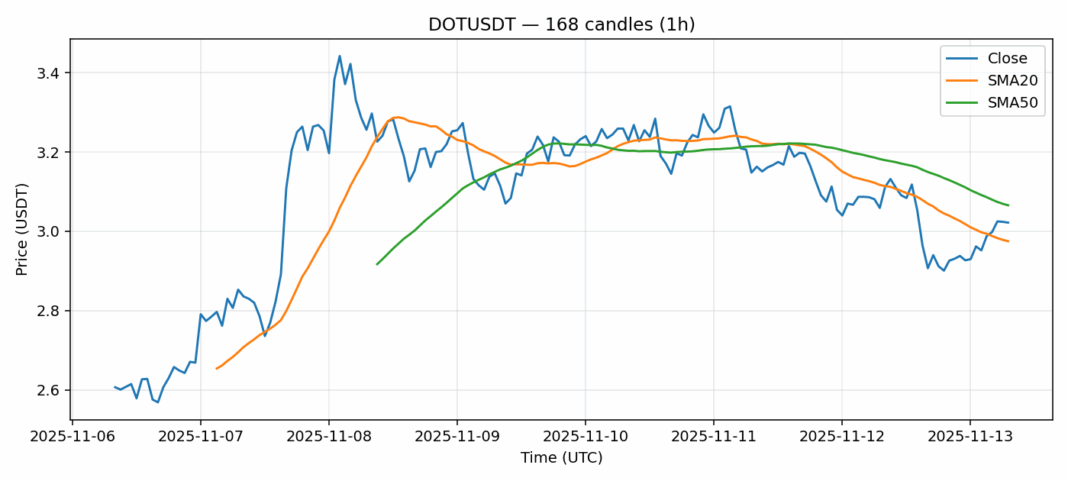

DOT is showing mixed signals as it trades at $3.022, down 1.88% over 24 hours despite healthy trading volume of $28.2 million. The current price sits above the 20-day SMA of $2.975 but below the 50-day SMA of $3.066, indicating potential resistance at higher levels. The RSI reading of 69.7 suggests DOT is approaching overbought territory, though not yet extreme. Volatility remains elevated at 6.85%, typical for mid-cap altcoins. For traders, the key level to watch is the $3.07 resistance – a decisive break above could target $3.20, while failure here might see a retest of $2.95 support. Given the technical setup, consider scaling into positions on dips toward $2.95 with tight stops below $2.90. The volume suggests institutional interest remains, but the overhead resistance presents a near-term challenge for bulls.

Key Metrics

| Price | 3.0220 USDT |

| 24h Change | -1.88% |

| 24h Volume | 28260775.48 |

| RSI(14) | 69.71 |

| SMA20 / SMA50 | 2.98 / 3.07 |

| Daily Volatility | 6.85% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).