Sentiment: Neutral

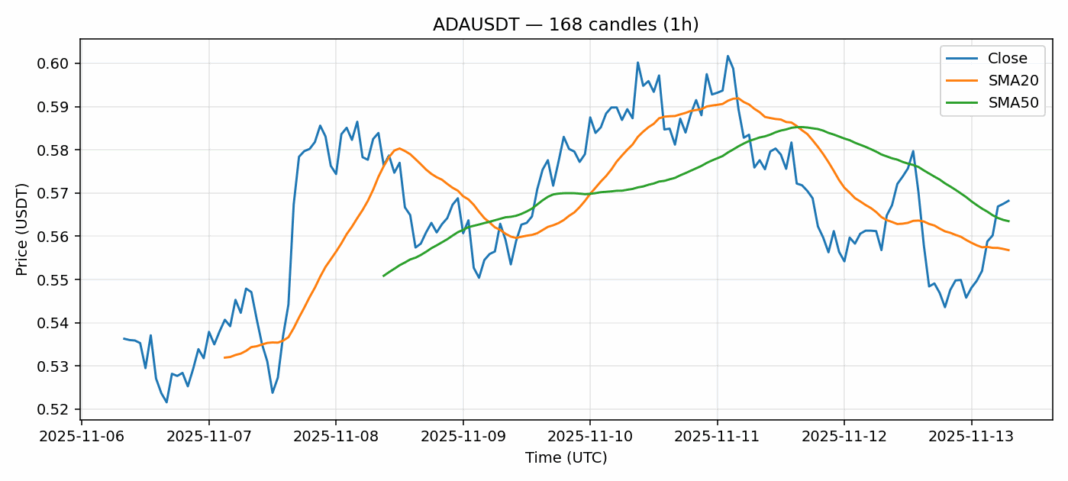

ADA is showing mixed signals as it trades at $0.5682 with modest 1.37% gains over the past 24 hours. The current price sits above the 20-day SMA ($0.5568) but below the 50-day SMA ($0.5635), indicating potential consolidation. More concerning is the RSI reading of 74.93, which places ADA in overbought territory and suggests a near-term pullback may be imminent. Trading volume of $59.8 million remains healthy, providing adequate liquidity, while volatility at 4.47% indicates moderate price swings. For traders, consider taking partial profits at current levels given the overbought conditions. Wait for a retest of the 20-day SMA support around $0.556 for fresh long entries. Risk management remains crucial – set stop losses below $0.545 to protect against sudden downside moves. The overall structure remains constructive, but patience for better risk-reward entries is advised.

Key Metrics

| Price | 0.5682 USDT |

| 24h Change | 1.37% |

| 24h Volume | 59831587.81 |

| RSI(14) | 74.93 |

| SMA20 / SMA50 | 0.56 / 0.56 |

| Daily Volatility | 4.47% |

Cardano — 1h candles, 7D window (SMA20/SMA50, RSI).