Sentiment: Bullish

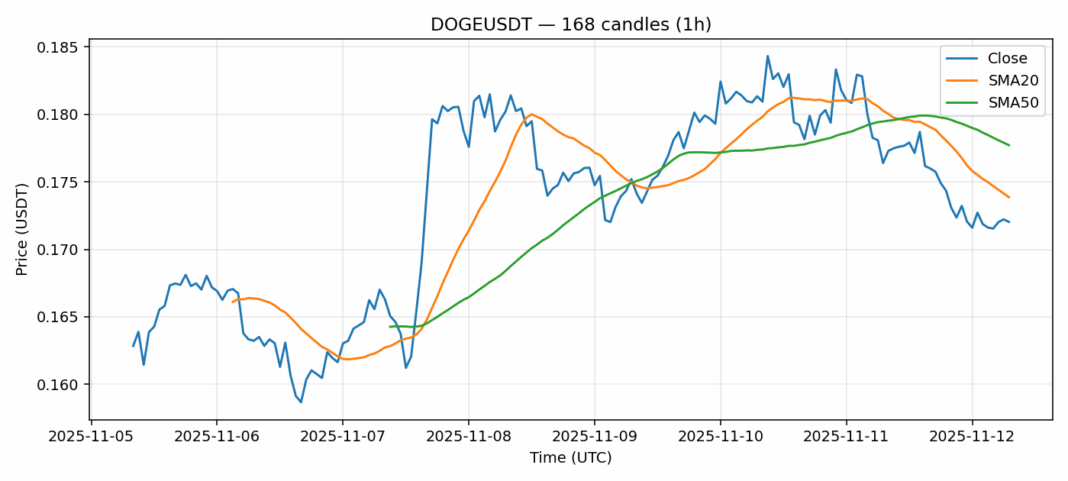

DOGE is showing signs of capitulation with a 3.36% decline pushing price to $0.172, dangerously close to oversold territory. The RSI reading of 29.5 indicates extreme selling pressure that historically precedes potential bounces in meme coins. Current price sits below both the 20-day SMA ($0.174) and 50-day SMA ($0.178), confirming the bearish structure but also suggesting limited downside from here. The elevated 4% volatility combined with substantial $153M daily volume signals active accumulation by contrarian traders. For position traders, scaling into long positions between $0.168-$0.172 offers favorable risk-reward, targeting a retest of the $0.178 resistance level. Day traders should watch for bullish divergence on lower timeframes and consider quick scalps on any positive catalyst. Stop losses should be placed below $0.165 for swing positions.

Key Metrics

| Price | 0.1720 USDT |

| 24h Change | -3.36% |

| 24h Volume | 152931824.39 |

| RSI(14) | 29.50 |

| SMA20 / SMA50 | 0.17 / 0.18 |

| Daily Volatility | 4.04% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).