Sentiment: Neutral

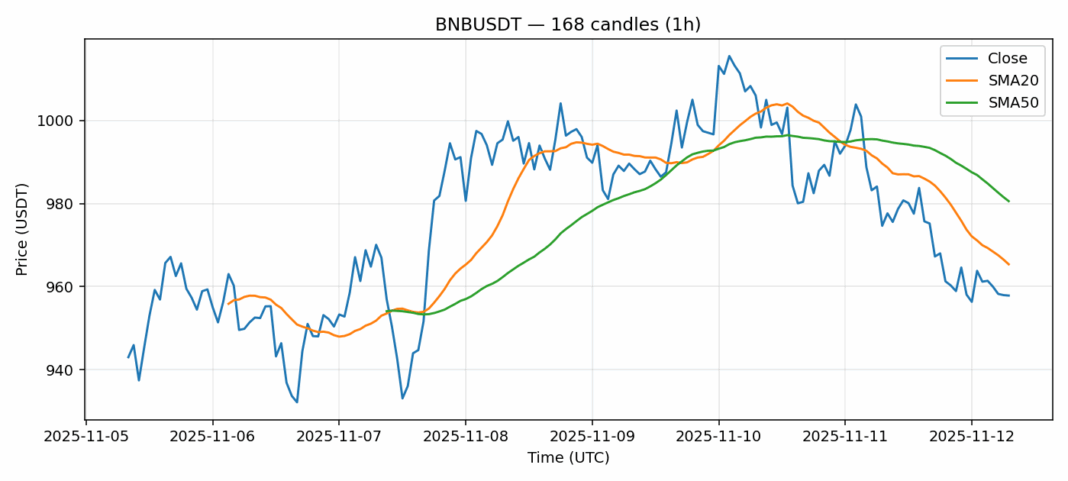

BNB is currently trading at $957.86, showing modest weakness with a 2.7% decline over the past 24 hours. The technical picture reveals several key developments worth monitoring. The RSI reading of 37.5 indicates BNB is approaching oversold territory, which often precedes potential buying opportunities for swing traders. Currently trading below both the 20-day SMA ($965.37) and 50-day SMA ($980.56), BNB faces immediate resistance around these levels. The relatively high volatility of 2.86% suggests continued price swings are likely. Volume remains substantial at nearly $230 million, indicating active institutional and retail participation. For traders, consider scaling into long positions between $940-950 with tight stops below $930. A break above the 20-day SMA could signal momentum shifting bullish, targeting $980-1000 resistance zones. Risk management remains crucial given the current market uncertainty.

Key Metrics

| Price | 957.8600 USDT |

| 24h Change | -2.70% |

| 24h Volume | 229730193.35 |

| RSI(14) | 37.51 |

| SMA20 / SMA50 | 965.37 / 980.56 |

| Daily Volatility | 2.86% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).