Sentiment: Neutral

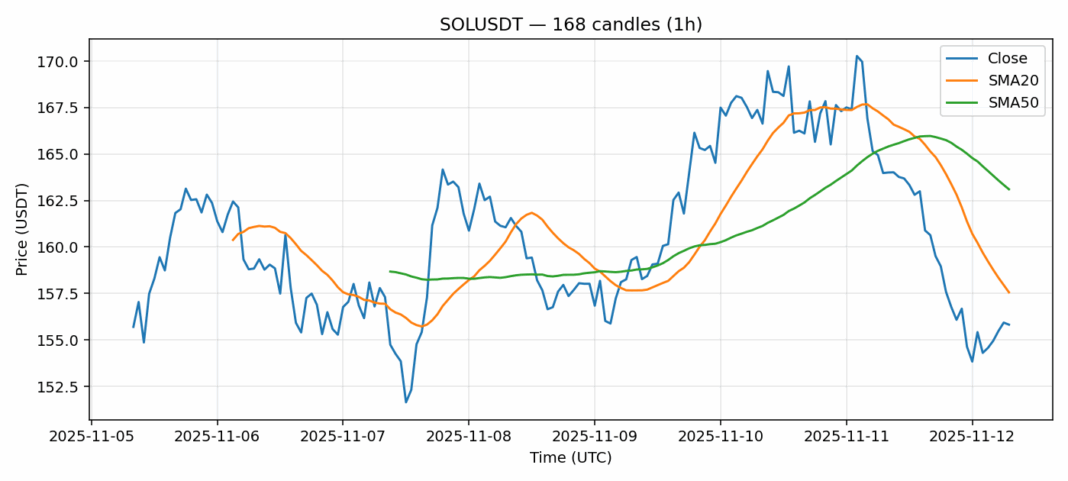

SOL is currently trading at $155.82, showing a 5.5% decline over the past 24 hours amid broader market weakness. The technical picture reveals several key developments: SOL has dipped below its 20-day SMA of $157.56 and remains well under its 50-day SMA of $163.11, indicating persistent selling pressure. However, the RSI reading of 33.7 suggests SOL is approaching oversold territory, which could present a potential buying opportunity for patient investors. The 24-hour trading volume of $665 million remains healthy, indicating continued institutional interest despite the price decline. Current volatility at 3.87% reflects typical crypto market conditions. For traders, consider accumulating positions near current levels with tight stop losses around $150. The oversold RSI combined with strong underlying volume suggests a potential rebound toward $160-165 resistance zones could materialize in the coming sessions. Risk management remains crucial given the ongoing market uncertainty.

Key Metrics

| Price | 155.8200 USDT |

| 24h Change | -5.53% |

| 24h Volume | 665425446.44 |

| RSI(14) | 33.72 |

| SMA20 / SMA50 | 157.56 / 163.11 |

| Daily Volatility | 3.87% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).