Sentiment: Bullish

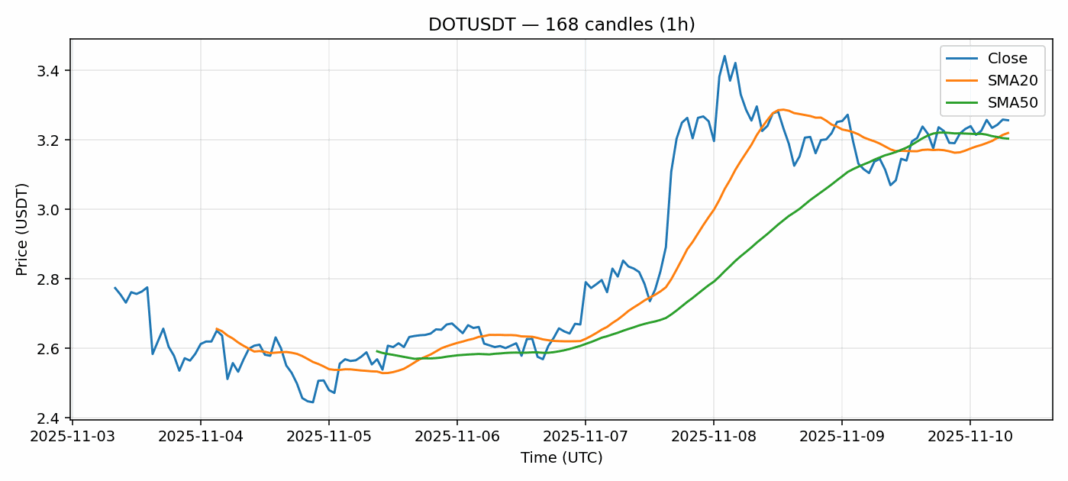

DOT is showing encouraging momentum today, climbing 3.63% to $3.257 amid solid trading volume of $36.4 million. The current price sits comfortably above both the 20-day SMA ($3.220) and 50-day SMA ($3.204), indicating underlying bullish structure. With RSI at 64.8, DOT approaches overbought territory but hasn’t yet crossed the critical 70 threshold that typically signals exhaustion. The 7.6% volatility reading suggests moderate price swings are expected. For traders, consider accumulating on any pullbacks toward the $3.20 support zone, which should hold given the SMA confluence. Resistance appears around $3.35-$3.40 based on recent price action. Position sizing should account for potential volatility spikes, and stop losses below $3.15 would protect against any breakdown below key moving averages. The volume profile suggests genuine institutional interest rather than retail speculation.

Key Metrics

| Price | 3.2570 USDT |

| 24h Change | 3.63% |

| 24h Volume | 36433106.14 |

| RSI(14) | 64.84 |

| SMA20 / SMA50 | 3.22 / 3.20 |

| Daily Volatility | 7.60% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).