Sentiment: Bullish

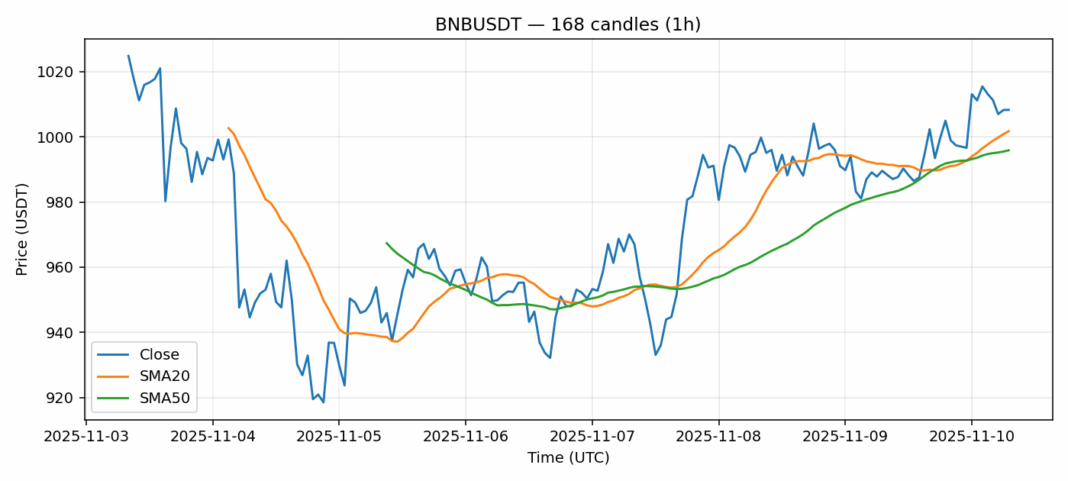

BNB is showing solid momentum, trading at $1,008 with a 2% gain over the past 24 hours. The current price sits above both the 20-day SMA ($1,002) and 50-day SMA ($996), indicating a healthy uptrend remains intact. Volume remains robust at nearly $294 million, suggesting sustained institutional interest. The RSI reading of 64 sits in bullish territory but hasn’t yet reached overbought levels, leaving room for further upside. However, traders should note the 4% volatility reading, which suggests potential for sharp moves in either direction. For position traders, holding with a stop-loss below the 50-day SMA around $990 makes sense. Swing traders might consider adding on any pullbacks toward the $1,000 support level. The key resistance to watch remains the $1,020 level, which if broken, could trigger another leg higher toward $1,050.

Key Metrics

| Price | 1008.2900 USDT |

| 24h Change | 2.04% |

| 24h Volume | 293641119.51 |

| RSI(14) | 64.16 |

| SMA20 / SMA50 | 1001.73 / 995.87 |

| Daily Volatility | 4.09% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).