Sentiment: Bullish

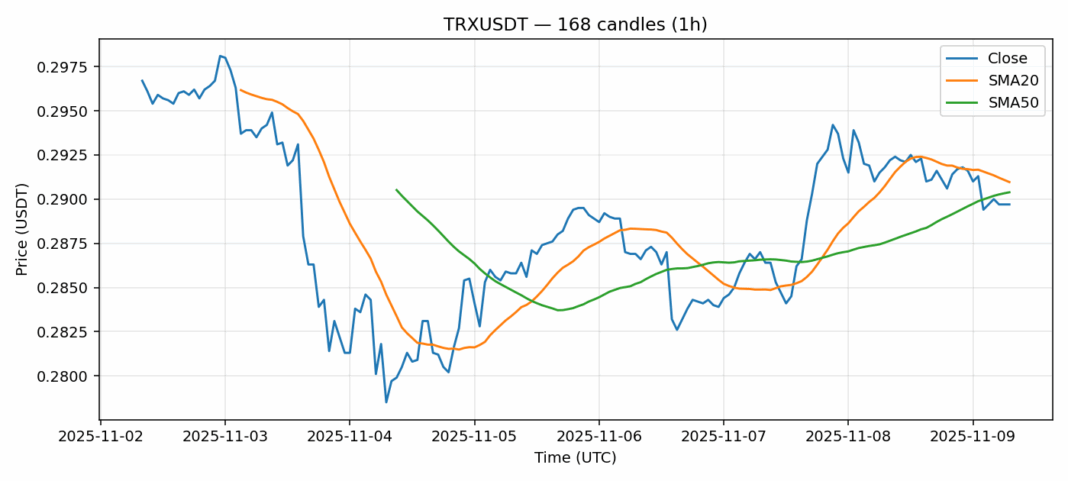

TRX is showing signs of potential reversal after recent weakness, trading at $0.2897 with a modest 24-hour decline of 0.62%. The technical picture reveals an oversold condition with RSI at 34.4, suggesting selling pressure may be exhausting. Current price action finds TRX trading slightly below both the 20-day SMA ($0.2910) and 50-day SMA ($0.2904), indicating short-term bearish momentum but with key support levels nearby. The 24-hour volume of $47.4 million demonstrates healthy liquidity, while volatility at 1.9% suggests relatively stable conditions. For traders, the oversold RSI combined with proximity to major moving averages presents a potential accumulation opportunity. Consider establishing long positions with tight stops below $0.2850, targeting a retest of the $0.2950 resistance level. Risk management remains crucial given the current technical weakness.

Key Metrics

| Price | 0.2897 USDT |

| 24h Change | -0.62% |

| 24h Volume | 47424751.53 |

| RSI(14) | 34.43 |

| SMA20 / SMA50 | 0.29 / 0.29 |

| Daily Volatility | 1.90% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).