Sentiment: Bullish

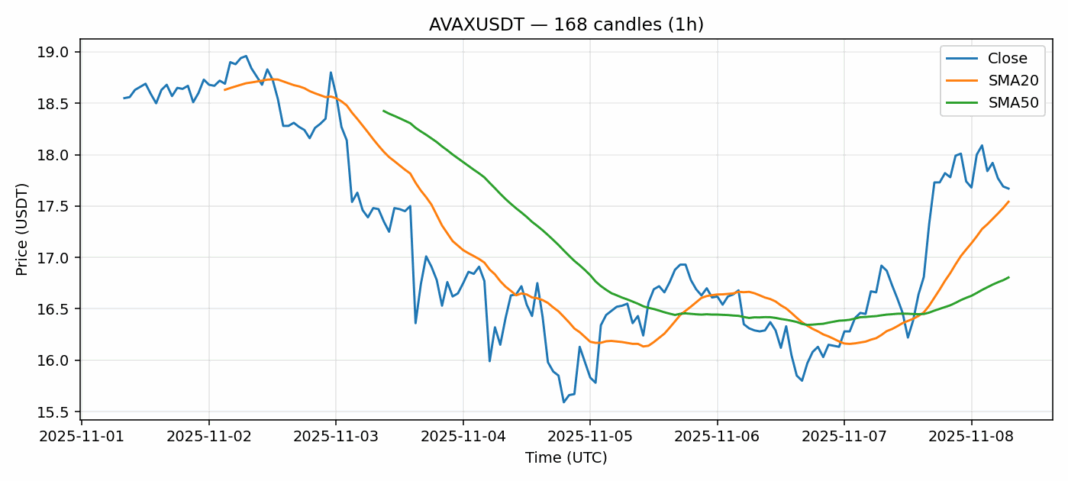

AVAX is showing encouraging technical signals as it trades at $17.67, posting a solid 5.68% gain over the past 24 hours. The token has successfully reclaimed its 20-day SMA at $17.54 and maintains a comfortable position above the 50-day SMA at $16.80, suggesting underlying strength in the medium-term trend. With RSI at 48.21, AVAX remains in neutral territory with ample room for upward movement before hitting overbought conditions. The $121 million trading volume indicates healthy participation, while the 5.86% volatility reading suggests manageable price swings. Traders should watch for a sustained break above $18.00, which could trigger momentum toward the $19-20 resistance zone. Consider accumulating on dips toward the $17.20 support level with stops below $16.50. The current setup favors cautious optimism as AVAX builds momentum for a potential breakout.

Key Metrics

| Price | 17.6700 USDT |

| 24h Change | 5.68% |

| 24h Volume | 121781578.26 |

| RSI(14) | 48.21 |

| SMA20 / SMA50 | 17.54 / 16.80 |

| Daily Volatility | 5.86% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).