Sentiment: Neutral

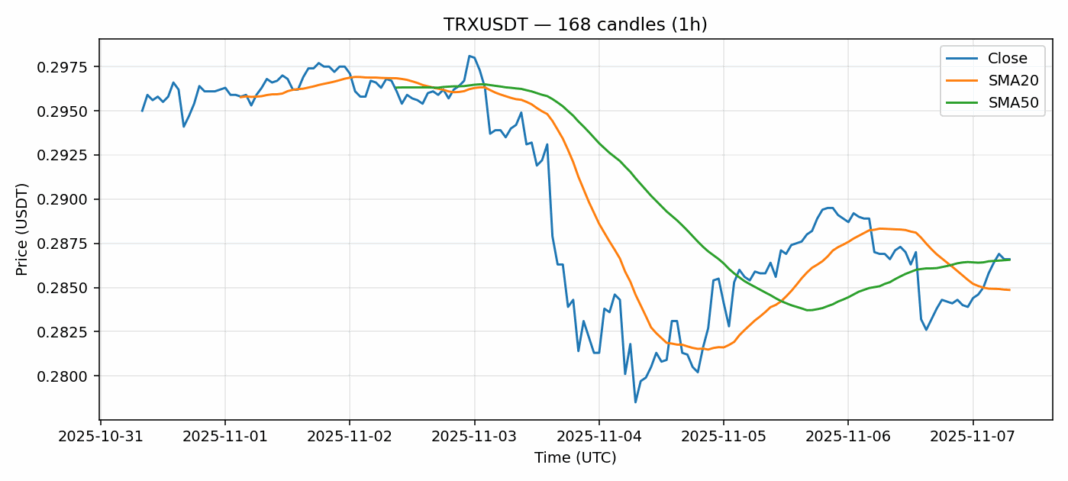

TRX is showing mixed signals as it trades at $0.2866, down slightly by 0.07% over 24 hours. The RSI reading of 80.43 indicates severely overbought conditions, suggesting a potential pullback may be imminent despite the strong volume of $86.8 million. Price action finds itself sandwiched between the 20-day SMA at $0.28486 and 50-day SMA at $0.28656, creating a crucial technical battleground. The elevated volatility of 1.78% reflects heightened market uncertainty. Traders should consider taking partial profits near current levels and wait for a healthy retracement toward the $0.282-0.284 support zone before adding new positions. Risk management is paramount given the overextended technical readings. A break below the 20-day SMA could trigger further selling toward $0.280, while sustained buying above $0.288 might signal continued upward momentum.

Key Metrics

| Price | 0.2866 USDT |

| 24h Change | -0.07% |

| 24h Volume | 86825012.95 |

| RSI(14) | 80.43 |

| SMA20 / SMA50 | 0.28 / 0.29 |

| Daily Volatility | 1.78% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).