Sentiment: Bullish

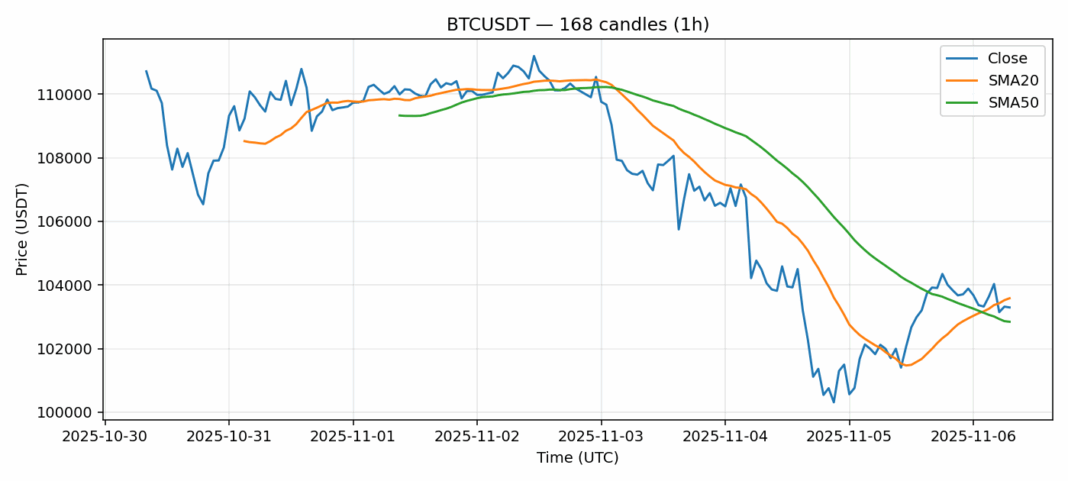

Bitcoin is currently trading at $103,293, showing modest 24-hour gains of 1.16% as the market consolidates following recent volatility. The RSI reading of 41.7 indicates BTC is approaching oversold territory, potentially setting up for a near-term bounce. Price action remains tightly range-bound between the 20-day SMA at $103,582 and 50-day SMA at $102,843, suggesting a critical inflection point. Trading volume of $2.53 billion reflects healthy market participation, while volatility has moderated to 2.47%. For traders, current levels present a compelling risk-reward setup. Consider scaling into long positions on any dips below $102,800 with tight stops around $102,500. Resistance at $104,000 remains the key level to watch for breakout confirmation. The consolidation pattern suggests accumulation is occurring, and a decisive move above the 20-day SMA could trigger momentum buying. Position sizing should remain conservative given the compressed volatility environment.

Key Metrics

| Price | 103293.7800 USDT |

| 24h Change | 1.16% |

| 24h Volume | 2528328590.87 |

| RSI(14) | 41.73 |

| SMA20 / SMA50 | 103582.60 / 102843.41 |

| Daily Volatility | 2.47% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).